How Virtual CFOs Help MSMEs Stay Compliant and Investor-Ready?

Wants to know about the role of a virtual CFO for MSMEs, and the vCFO service helps them in their success, staying compliant and investor-ready.

And the profits of a Virtual CFO for MSMEs compliance are like a startup company.

MSMEs are those companies that are small and medium-sized. A startup company is like a seedling for the market, and MSMEs are like a sapling in the middle stage. So, when a startup company grows then it becomes an MSME. At the stage of MSME, all founders require that their business become more aggressive and grow. So, in that case, the virtual CFO surely becomes the best choice for them. And those MSMEs that require legal compliance and investor-ready business, then in that case also a vCFO shines like a star.

A virtual CFO is known as an expert in services related to legal and investment-related matters. In the growing stage of different MSMEs, a virtual provides them with expert financial leadership in which includes cash flow management, creating budgets and forecasts, and ensuring tax compliance. This helps MSMEs in making better decisions for their business and provides a strong framework for sustainable growth.

Therefore, in this blog, you will learn about the role of a Virtual CFO for SME investors. And how it becomes beneficial for staying compliant and investor-ready for MSMEs.

1. Why MSMEs Need to Stay Compliant and Investor-Ready

When a startup becomes an MSME, then its requirements and desires increase because the growth increases. The responsibilities also increase with it. Due to this, MSME owners need the best investments and adhere to legal compliance. MSME owners also require these things in their businesses to gain long-term growth, credibility, and financial security. And MSME owners also want these regulations in their business to get the best business partners and investors.

For an MSME investor readiness, being investor-ready isn’t an easy task; it takes a strategic process for proving that the business is a low-risk, high-growth opportunity worthy of investment. Due to these reasons, MSME owners always stay focused on making their companies the best for investment purposes. The detailed points on these regulations are below:

For investment

- For reducing funding gaps – Many MSMEs don’t get funds from the banks or other institutions. Due to this, they go for the option of investors in which includes venture capitalists and angel investors, which helps them in filling their investment gaps.

- For widening funds – Obviously, if a startup grows and becomes an MSME, then with its growth, it also requires expanding operations, increasing production, and entering new markets. And in which investors help them in fulfilling it.

- To get network and expertise – Beyond the investment, an investor also provides many things to an MSME business, such as valuable strategic guidance, mentorship, and access to their professional networks, and mainly these things are done by an angel investor.

- Getting new technology – In this competitive market, the MSMEs also require new technologies for their businesses. And in that case also an investor helps them in getting new technologies.

- For bringing investors – Those MSMEs that are having fast growth in comparison to others, then for those, venture capital becomes the best choice for their equity finance. This allows them to get innovative projects that might otherwise be too risky.

For staying compliant

- Getting government support – When a startup becomes an MSME then it also requires access to numerous government schemes, subsidies, and tax benefits, which are important for any MSME to compete and grow.

- Enhances business value – When an MSME is fully compliant, it helps it build a reputation for transparency and reliability, which becomes beneficial in making relations with customers, partners, and investors. And a compliant business is seen as more trustworthy.

- Easily gets finances – An MSME that adheres to compliance can attract more lenders and investors. Due to which they have a high chance of getting of loan and more favorable terms.

- Not following legal penalties – If any MSME fails to adhere to compliance, then it might get different penalties, fines, legal action, and even the cancellation of licenses. Which gets removed by adhering to laws.

- Competitive advantage – Any MSME that requires government tenders and securing corporate contracts. Then the business needs to comply with legal regulations. This makes compliance a key differentiator in winning new business, notes.

Smart Financial Planning with Virtual CFO Services for SMEs

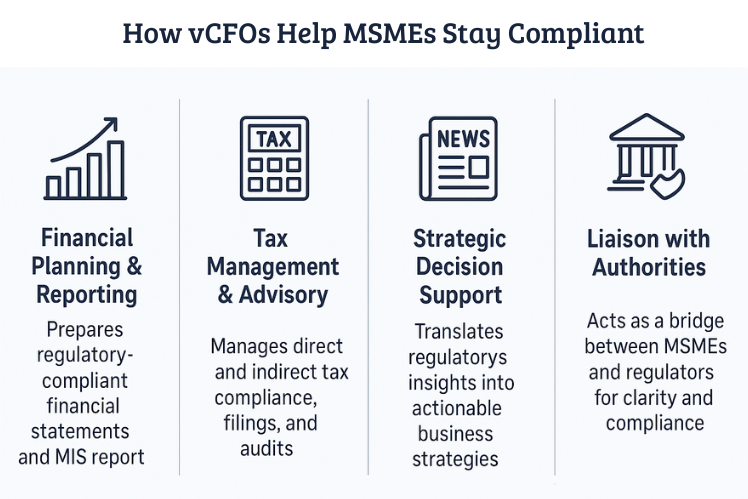

2. The Role of a vCFO in Providing MSMEs with these Regulations

A big challenge that comes in front of an MSME is having limited resources lack of financial expertise, and complex regulations. Due to this, they choose the virtual CFO services for these cases. Because of these issues, a virtual CFO provides expert, on-demand financial leadership at a very low amount of cost compared to other services.

The points at which a virtual CFO helps an MSME with financial services with these regulations are mentioned below:

With compliaces

- A virtual CFO helps MSMEs with their end-to-end compliance. In which he also includes tax filings (GST, income tax), regulatory filings (Companies Act), and labor laws, which reduces the risk of issues and non-compliances.

- A virtual CFO helps MSMEs by providing updated regulatory compliance support, which is compulsory for the bandwidth to track frequent updates in tax and corporate laws.

- A virtual CFO also helps an MSME with its strong internal controls and processes. It’s important for ensuring accurate record-keeping and audit preparedness.

- In an MSME, they ensure that all your financial and legal documents are perfectly prepared and aligned. This helps you in simplifying the process of responding to audits and official inquiries.

With investor-relations

To increase your relations with your investor, the best virtual CFO services your MSME to the best services with its full potential. Due to this, many investors and fundraisers can easily be attracted to your company. Provides your MSME company with many strategies and new planning. Due to this, it becomes easy for you to manage your investors easily. And the following are the steps of a vCFO, which he does.

- A vCFO provides more best and reliable services compared to a bookkeeper. They create robust financial plans, budgets, and forecasts that perfectly fit with your business requirements. And also what is important for attracting investors.

- Providing clear and accurate financial reports, which include balance sheets, cash flow statements, etc., which are important for due diligence.

- With checking your financing options, like debt, a vCFO provides a strategy for enhancing capital structure, making it a more attractive and stable investment.

- A vCFO is capable of creating valuation analyses, financial models, and investor presentation decks. Additionally, they frequently use their network to connect MSMEs with possible lenders and investors.

- For an MSME, the virtual CFO for startups is an external partner for their business who provides perfect assessments for the business’s financial health and identifies areas for operational improvement, which attracts investors to any MSME.

3. MSMEs, Simplify Finances with LegalRaasta’s Virtual CFO

LegalRaasta is an authenticated company that provides a ton of services to entrepreneur founders and manufacturers. We also offer virtual CFO services, enabling you to obtain growth easily. Startups and scaling companies have the opportunity to avail of a virtual CFO from LegalRaasta without any hassle for every business owner or seller. Finding a trusted virtual CFO provider isn’t easy; there really aren’t that many out there. We’re one of them. And it doesn’t end there; we offer a whole range of services, from virtual CFO to company registration, LLP registration, and NBFC registration. Just browse our website and choose what fits your needs. We’re here to help you step up your financial game in today’s competitive market.