RCMC Certificate Online Application

Overview

The Foreign Trade Policy (FTP) has been formulated for exporters. Under FTP, the businesses can access the benefits associated with the government export incentive schemes. To access any government schemes or incentives by an exporter, a valid certificate is required. This certificate legally demonstrates that the business has been recognized by the Directorate General of Foreign Trade (DGFT). On this front, the RCMC plays a crucial role. In this comprehensive guide, we will explore what an RCMC certificate Online is, including its advantages, the cost of the certificate, required documents, and how to apply online for it. Take a look for more details below.

What is the RCMC Certificate in India?

RCMC, as “Registration-Cum-Membership Certificate,” is a legal document obtained by the exporting organization in India. Meanwhile, the Export Promotion Councils (EPCs) or Commodity Boards are responsible for issuing the certificate. The certificate is the proof that determines that the exporter and manufacturer are registered with the relevant bodies.

Furthermore, before benefiting from government schemes and incentives, the exporting organization has to produce a legal certificate. It grants permission to them to participate in international trade events, including availing financial advantages.

If you obtain the certificate of RCMC, it demonstrates that you have an exporter membership with an Indian government-authorized export body.

Importance of RCMC Registration for Importers

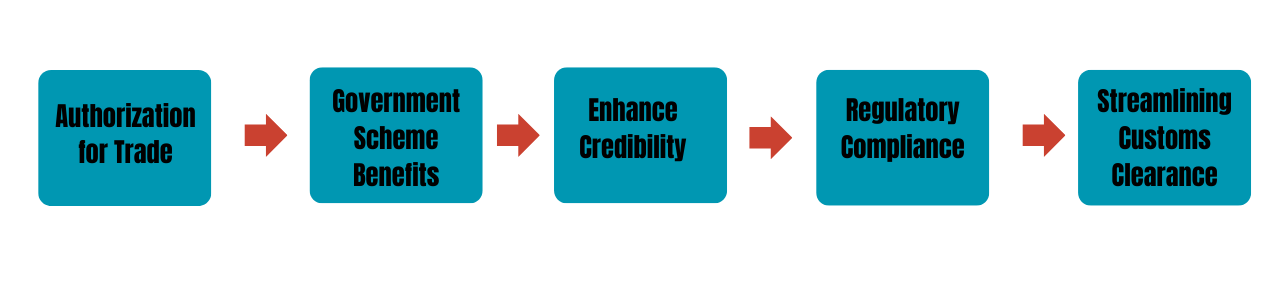

With the RCMC registration certificate, the exporter gets the authorization for trade. Meanwhile, it is essentially required to import restricted goods. This can be understood as –

Authorization for Trade

With the certificate of RCMC, the operators get the legal authorization to import and export specific category products. Eve, the products that have been restricted by FTP can be imported and exported with this certificate.

Government Scheme Benefits

The Indian government offers various financial schemes and incentives that can only be accessed with a certificate of RCMC. It means, to access government benefits, this certificate is mandatory.

Enhance Credibility

It creates a reputational image of those businesses that participate in international trade. Enhancing credibility, it builds the trust of global suppliers and customers.

Regulatory Compliance

Having the RCMC document means the exporter aligns with specific rules and regulations that are required to smooth international trading.

Streamlining Customs Clearance

With the certificate, the businesses can get approval for customs clearance easily. Along with the RCMC certificate, AD Code registration is also mandatory for customs clearance. It reduces not only the time but also the effort required to pass a stringent set of guidelines.

The Involved Authority to Provide RCMC Certificate

There is not a single authority involved, but it is handled by a broad administrative department. Various Export Promotion Councils (EPCs), Commodity Boards, and the FIEO are responsible for issuing the RCMC to exporters. Meanwhile, these departments are categorized according to the specific product requirements. These authorities are designed by the Indian government in India under the DGFT. There are several businesses or exporters who manage a wide range of products and can obtain a certificate from the FIEO. Here it is in more detail:

- Export Promotion Councils (EPCs): Multiple EPCs are located in India, which target a specific category of products or industries.

- Commodity Boards: It is responsible for the management or registration of a specific type of raw material or primarily agricultural product.

- Development Authorities: It also falls under the purview of DGFT. Majorly designed to issue RCMCs to a specific category of products.

- FIEO: The Federation of Indian Exporters Organization was introduced for those exporters who operate in various products. The exporters whose products do not fit the above-mentioned bodies register with FIEO for the certificate.

How Many Recognized Bodies Under DGFT?

The Export Promotion Councils (EPCs)

- Council for Leather Exports

- The Gem and Jewellery Export Promotion Council

- Carpet Export Promotion Council

- Handloom Export Promotion Council

- Apparel Export Promotion Council

- Chemicals and Allied Products Export Promotion Council (CAPEXIL)

- Engineering Exports Promotion Council

- The Plastics Export Promotion Council

- Agricultural and Processed Food Products Export Development Authority

- Export Promotion Council for Handicrafts

- Pharmaceuticals Export Promotion Council of India

- Cashew Export Promotion Council of India

- The Cotton Textiles Export Promotion Council (TEXPROCIL)

- Electronics and Computer Software Export Promotion Council

- Federation of Indian Export Organisations

- Project Exports Promotion Council Of India

- Services Export Promotion Council

- Marine Products Export Development Authority

The Commodity Boards

- Tea Board

- Coffee Board

- Rubber Board

- Species Board

- Tobacco Board

- National Turmeric Board

Note: The National Turmeric Board has been added in recent years (2024) to the commodity board. It means the purpose is to boost turmeric production.

The Development Authorities

- Electronics Industries Development of India (ELCID)

- National Centre for Trade Information (NCTI)

What is the eligibility requirement for RCMC registration?

It should be noted that not every business is eligible for RCMC registration. The key eligibility requirements are

Associated with Export Activities

- The businesses that are applying for the registration of RCMC must be active in the sector of export-import sector from India.

Have Import-Export Code (IEC)

- Without it, the exporters are restricted from obtaining the certificate. For the IEC registration, register with DGFT.

Participate in EPC/Board

- Another requirement is that the exporter must be a member of the EPC or the Commodity Board that promotes the relevant brand.

Register as Legal Entity

- The business must be legally registered under any company legal structure. It can be either a private limited company, an LLP, or a sole proprietorship.

No Blacklisting or default

- The exporting business is not blocked by any government body. Including that it is not found guilty of an export-related regulation.

Categorization of Exporter/Importer Covers in RCMC

The registration-cum-membership certificate covers a wide range of exporters and importers. Meanwhile, they are categorized on the basis of their business activities. The major types of exporters/importers are:

- The merchant exporters act as the traders. Their basic role is to buy goods from Indian domestic markets and sell internationally. However, in this situation, they do not manufacture the products. This means that between the client and a manufacturer, a merchant exporter is an intermediary.

- The manufacturer exporters are those who have their own facilities for manufacturing. They generally produce the products themselves and sell directly in the exporting country.

- The companies and individuals come under the service exporter category. These companies can be in IT, healthcare, or consulting, and they provide services to a foreign client.

- An exporter who deals with multiple products and also exports to other countries comes under the category of “multi-product exporters.” In this situation, this category of exporters receives the certificate from FIEO.

- Various entities are associated with the project export. Therefore, they are a type of project exporter.

- The business or individual associated with government-backed projects is treated as the deemed exporter

The Required Documents for RCMC Registration

For the successful and hassle-free registration, the exporter is required to prepare several documents. The supported paperwork is:

|

Import-Export Code (IEC) The exporter must obtain the IEC code from the DGFT. |

|

PAN Card Provide the business’s Permanent Account Number or the individual who is applying. |

|

GST Registration Certificate GST certificate as proof of goods and services registration. |

|

Identity & Address Proof Personal information of the applicants, like Aadhaar Card, passport, or voter ID. Proof of address is also required for registration. |

|

Business registration proof For the entity registration details, the MoA and AOA, including the partnership deed, are enough. |

|

Bank details The bank details are required of the exporter for verification. |

|

Board Resolution or Power of Attorney Mandatory when the authorized signatory’s name is not outlined in any government foundational document. |

What is the RCMC Registration Process—Step-by-Step Guide?

To obtain the certificate of RCMC (Registration-Cum-Membership Certificate), the applicant needs to follow a multi-step process. The steps include:

Apply for IEC

The Import-Export Code is important for the registration process. Apply for the IEC code through the DGFT online portal.

Identify your EPC/Commodity Board

According to your service of products, determine the specific commodity board or EPC. The selected authority by you is responsible for presenting your product or service. To identify the correct EPC/commodity board, visit the DGFT website.

Navigate the application platform

Access the e-RCMC platform by visiting the DGFT website. Mention the IEC and password to access the platform.

Complete Registration Form

Fill out the necessary details along with the attached supporting documents. The details you need to provide are business registration proof, company name, address, etc.

Submit Supported Documents

The documents must be accurate, up-to-date, and error-free. Scanned the documents in a specific range of formats.

Pay Registration Fees

To obtain the RCMC certificate, the applicant needs to pay the prescribed fees. However, the fees can be different according to the specific authority you have selected.

RCMC Certificate Approval

You will receive the RCMC certificate online after you submit your application and cross-check the documents.

Renewal of-Registration-Cum-Membership Certificate

The RCMC certificate is valid for a specific period of time. From the date of issuance, it is active for only 5 years. However, it is essential to note that the renewal process should be done at least 30-60 days before certificate expiry.

The prerequisite for renewal is that the IEC should be active, and the included profile must be updated. To navigate the process of renewal, visit the DGFT website and fill out the required details.

Manage RCMC Compliance to Avoid Legal Penalties

Receiving the Registration-Cum-Membership certificate is not the last part. The exporter needs to stay compliant after certificate approval. The compliance norms that you need to follow are as follows:

- The renewal of the RCMC certificate is essential, as it is active only for five years. Failure to renew the license can cause serious legal trouble.

- This is critical for exporters to comply with the export-import policy.

- Must maintain the annual export data and submit it to DGFT. If you fail to do the same, it can raise serious challenges such as certificate suspension or cancellation.

- Adhering to the product’s quality standard is also crucial. Must ensure that you follow the specific importing country’s rules and regulations.

Get RCMC Certificate in a Short Time with LegalRaasta

At LegalRaasta, we are experts in assisting businesses to get their valuable certificates in a short duration. Reduce your tension with our assistant. We are responsible for guiding you, including managing the documents, ensuring you adhere to regulatory requirements, and much more. In the end, we make the registration process for RCMC hassle-free.

The other services we offer apart from RCMC are:

- Provides DSC for Authorized Dealer Code registration.

- Issue GST Registration Certificate

- Apply for a BIS certificate if your service falls under mandatory registration.

- Manage the CDSCO registration process

- Navigate the EPR certification process for your plastic packaging or battery services

- Legally sell, stock, and distribute medical devices as we handle the MD-42 registration certification procedure.

FAQ | RCMC Certificate Registration for Government Schemes

-

Why is registration for the RCMC certificate online crucial?

Ans. Obtaining the certificate is crucial for various reasons. With it, the exporters get the legal authorization to import and export restricted products under FTP. In addition, it provides the legal identity to the exporter and attaches to the Export Council or Commodity as a member. In the last, it is mandatory to access the government schemes and subsidies.

-

Who is eligible to fill out the RCMC application?

Ans. The individual or business associated with import-export dealings.

-

How long can an RCMC certificate be active?

Ans. The validity of the certificate is only for 5 years.

-

In how many days will I receive the certificate of RCMC?

Ans. After the application and registration process, the exporter will receive the certificate between 7 and 10 working days.

-

How can LegalRaasta help with RCMC registration?

Ans. The experts of LegalRaasta assist with registration. They will check if the documents provided by you are correct. We provide end-to-end service.