Our software supports TDS on Salary payments (Form 24Q), Rent, Interest, Commission, and other Non-salary transactions (Form 26Q), NRI (Form 27Q), and TCS (Form 27EQ).

Import data from Excel and TDS files

Automatically verify TAN and PAN number

Import data from Excel and TDS files

Automatically Calculate TDS

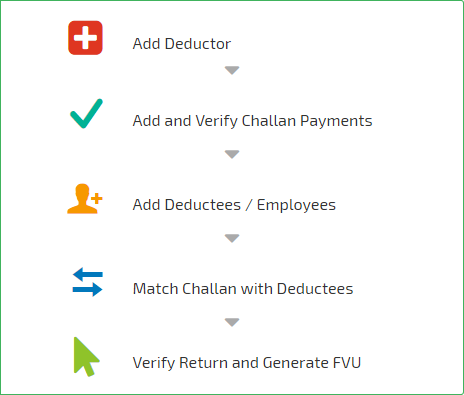

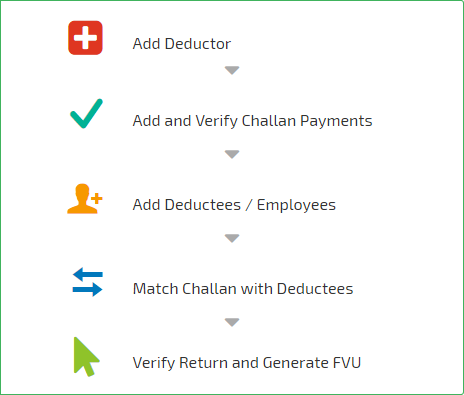

Submit the return in FVU format without any difficulty

Generate Form 16, 16A, and more with ease

TDS (Tax Deducted at Source) is an associate indirect system of deduction of tax in line with the

taxation Act, 1961 at the purpose of generation of Income. Tax is deducted by the payer and is

dispatched to the government by him on behalf of the recipient.

A TDS Return could be a quarterly statement that must be submitted to the taxation department of

India. Submitting TDS Return is necessary if you’re a

deductor. It has details of TDS deducted and

stored by you.

| Section | Particulars | TDS Rates in % | Threshold limits |

|---|---|---|---|

| 192 | Salary | As per the rates of Income Slab | As per the rates of Income Slab |

| 192A | Payment of accumulated balance of provident fund which is taxable in the hands of an employee | 10 | – |

| 193 | Interest on securities | ||

| a) Interest on Securities | 10 | Nil | |

| b) Interest on Debentures; | 10 | Nil | |

| 194 | Dividend (other than the listed companies) | 10 | Nil |

| 194A | Income by way of interest other than interest on securities | 10 | Rs. 5,000 |

| 194B | Winnings from lotteries/ puzzles/card games. | 30 | Rs. 10,000 |

| 194BB | Income by way of Winnings from horse races | 30 | Rs. 5,000 |

| 194C | Payment to contractor/sub- contractor a) HUF/Individuals b) Others | 1 2 | Rs. 30,000 |

| 194D | Insurance commission | 5 | Rs. 20,000 |

| 194DA | Payment in respect of life insurance policy | 1 | – |

| 194EE | Payment of NSS Deposits | 10 | Rs. 2,500 |

| 194F | Payment on account of repurchase of unit by Mutual Fund or Unit trust of India | 20 | Nil |

| 194G | Commission on sale of lottery tickets | 5 | Rs. 1,000 |

| 194H | Commission or brokerage | 5 | Rs. 5,000 |

| 194-I | Rent a) Plant & Machineryb) Land or building or furniture or fitting | 2 10 | Rs. 1.8 lakhs |

| 194-IA | Payment on transfer of certain immovable property other than agricultural land | 1 | – |

| 194-IB | Payment of rent by individual or HUF not liable to tax audit | 5 | – |

| 194-IC | Payment of monetary consideration under Joint Development Agreements | 10 | – |

| 194J | Any sum paid by way of

|

10 | Rs. 30,000 |

| 194LA | Payment of compensation on acquisition of certain immovable property | 10 | Rs. 1 lakh |

| 194LBA | Income distribution by a Business Trust u/s 115UA | 10 | – |

| 194LBB | Income distribution by a Investment Fund u/s 115UB | 10 | – |

| 194LBC | Income distribution by a Securitisation Trust u/s 115TCA | 25% in case of Individual or HUF 30% in case of other individual | – |

| Any other Income | 10 | – |

| Type of Deductor | Payments made between April – Feb | Payments made in March |

|---|---|---|

| Government | Without Challan: Same day With Challan: On or before 7th of next month | Without Challan: Same day With Challan: On or before 7th of next month |

| Other than Government | On or before 7th of next month | On or before 30th April |

| Other than Government (payment u/s 194IA) | On or before 30th of next month | On or before 30th of next month |

LegalRaasta was founded on the principle that sophisticated legal and taxation services should be simple, modern, and inexpensive. We can serve our clients more efficiently thanks to cutting-edge practise technology.

By continuing past this page, you agree to our Terms and Conditions Privacy Policy and Refund Policy | Copyright © 2015-2024 LegalRaasta.com| All Rights Reserved