Online Professional Tax Registration – An Overview

All salaried individuals are subject to professional tax, which is enforced by state governments. All working professionals, such as chartered accountants, lawyers, and doctors, are subject to professional tax. It is assessed based on the person’s occupation, trade, or profession. All states have different tax rates, but the highest sum that can be assessed as professional tax is 2,500 dollars per year. let’s know about Online Professional Tax Registration.

Eligibility

Applicability of professional tax: In India, professional tax is imposed on all types of trades and professions. Every employee of a private company operating in India is required to pay it. Professional tax registration is the responsibility of every business owner, who is also responsible for professional tax deductions and payments.

Professional tax for self-employed: Any self-employed professional who has a regular monthly income is required to pay the professional tax. The term “professional” refers to persons who work in specific professions such as accounting, media, and so on.

Who is exempted from paying online professional tax?

Only a few people are free from professional tax restrictions, and the exemptions vary according to whatever state you live in. Individuals who meet the following criteria are free from professional taxation:

- Badli employees in the textile industry

- Women employed exclusively as agents under the directorate of small savings or Mahila Pradhan

- Members of the armed forces

- Individuals with permanent physical disabilities

- The age varies by state

- Badli workers in the textile industry Kshetriya Bachat Yojana (Kshetriya Bachat Yojana) is a government-

- Parents or guardians of mentally handicapped people.

Benefits

Here are some of the reasons why a professional tax payment should never be missed.

- Judicial requirement: Employers in various Indian states are required by the judiciary to get professional tax registration. They must deduct and pay the service taxes of all employees who work under them after they have registered.

- Avoid paying penalties: Failure to register as a professional taxpayer results in significant fines that increase over time.

- Simple to follow: Professional tax standards are simple to follow. The registration procedures can be completed quickly, and the subsequent steps are also simplified.

- Deductions: On the basis of the professional tax paid, deductions can be claimed in the salary. The deductions will be allowed in the calendar year in which the payments were paid.

- State government tax: Local governments and state governments have the authority to collect all professional taxes, including those based on employment, professional trades, and other factors. The amount of professional tax collected each year should not exceed $2500.

Documents Required

- PAN card of the firm/LLP attested by the company director • Proof of office location with NOC from the property owner • Proof of corporate bank account with the bank statement and a canceled cheque

- Board resolution/statement of consent by the partners • Shop and establishment certificate • Salary register and attendance register from all directors • Passport size photograph, address, and identity evidence from all directors • Board resolution/statement of consent by the partners

Online Professional Tax Registration – Detailed Process

- Step 1: All directors/partners/proprietors of the company must present their PAN card, address, and identity verification.

- Step 2: All personnel information must be provided.

- Step 3: Employees must complete the professional tax application form.

- Step 4: It will be submitted to the appropriate authorities by our expertise.

- Step 5: We will send you a basic acknowledgment within 5 to 7 business days.

- Step 6: In all major cities, the registration hard copy will be issued within 10 days.

- Step 7: It could take up to 15 to 20 working days in other locations.

Understanding the Online Professional Tax Registration Applicability

Firms/Companies/LLPs

Firms, LLPs, corporations, societies, HUFs, associations, clubs, and companies are all considered taxable entities in the case of professional tax. Under professional taxation, all of the branches involved will be treated as independent people.

Individuals (Professionals)

Medical representatives such as dentists, medical consultants, and doctors, as well as management consultants, tax consultants, surveyors, company secretaries, chartered accountants, insurance agents, engineers, architects, and contractors, are all considered professional individuals who must pay professional tax.

Partners and Directors

Professional tax should be paid by company directors, firm partners, LLP partners, and designated partners. Within 30 days of being assigned to these positions, they should register under the professional tax legislation.

Employers

The company/firm must obtain a professional tax enrollment certificate (PTEC) within 30 days of incorporation by registering on the government portal.

Within 30 days of hiring a staff member, the company/firm must have a professional tax registration certificate (PTRC).

Employers are required to deduct professional tax from the salaries of those under their supervision and submit it to the professional tax department when filing returns.

- Employers are required to deduct professional tax from the salaries of those under their employ and submit it to the professional tax department when filing returns. The employer must register with the professional tax department within 30 days of the law’s implementation.

What are the Consequences of Professional Tax Violation?

Though the exact penal interest or penalty varies depending on each state’s legislation board, all states will be penalized if they do not register once the professional tax legislation takes effect. Additionally, penalties will be assessed if payments are not made on time or if the return is not filed by the deadline.

Why Vakilsearch

Vakilsearch is here to help you whenever you need it. Here are some of the ways we may assist you with professional tax registration online:

Preparing the application

Preparing the application might be a difficult effort because the phrases and regulations are often difficult to comprehend. Our skilled tax specialists do a thorough analysis of the firm and develop a document for filing a tax application with the appropriate state government.

Filling out the application form

Our experts will then complete and send the legally signed form to the appropriate city or town agency.

Registration process

The application will next be thoroughly examined by the relevant state government (s). Your professional tax registration is complete once it is determined to be correct.

Professional Tax Registration Glossary

PT

Professional Tax

PTEC

Professional Tax Enrollment Certificate

PTRC

Professional Tax Registration Certificate

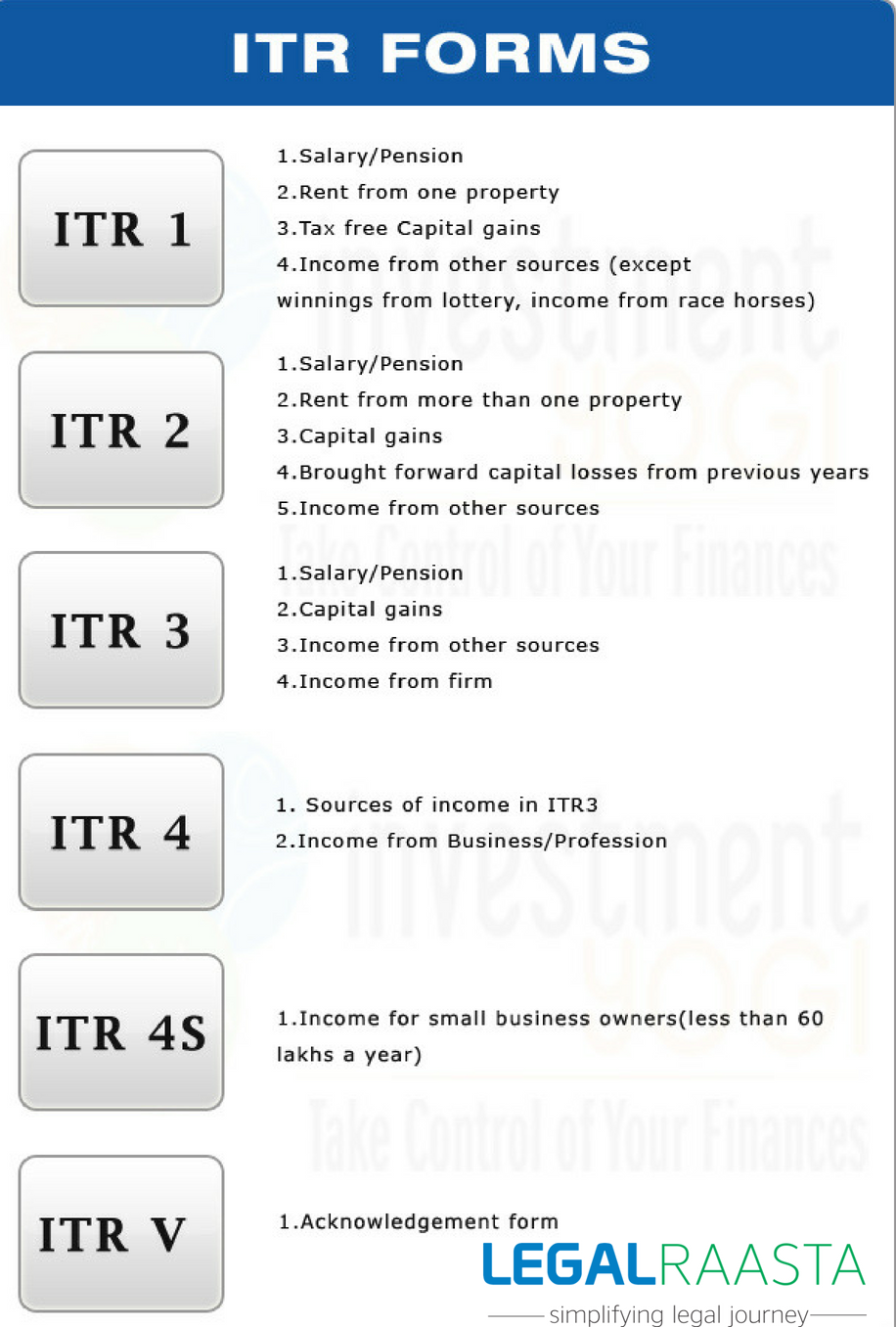

Direct Tax

Income, capital gains, and net worth are all subject to direct taxes. Direct taxes include gift taxes, death duties, and property taxes.

Double Taxation

When the same person gets taxed twice on the same income by more than one state, this is known as double taxation. If more than one person gets taxed on the same thing, double taxation is cost-effective.

Also, read: OLTAS: Online Tax Accounting System in India

Professional Tax for different states