Online Professional Tax Registration ...

All salaried individuals are subject to professional tax, which is enforced by state governments. All working professionals, such as chartered acco...December 12, 2021 | Sakshi Sachdeva

Income Tax Rebate Under Section 87A

Introduction Indian Income Tax Rebate Under Section 87A is one of the Indian income tax provisions that help Indian taxpayers reduce their Indian...December 08, 2021 | Parmeet Chhabra

SECTION 119 OF INCOME TAX ACT

INTRODUCTION India’s Income Tax Act is one of India’s most important laws. India has a complex tax system with multiple levels of taxation, and S...October 04, 2021 | Parmeet Chhabra

Latest Income Tax Slab Rates FY 2020-21

In the Latest ITR Slab 2020, the finance minister " Nirmala Sitharaman" declared the deduction in income tax rates. The new rates, individuals who ...February 04, 2020 | Parmeet Chhabra

Income Tax Return Filings rise by 26%...

Tax Taboo Let's face the facts, The Government of India is no stranger to the problem of tax evasion, willful defaulters and black money hoarders....September 14, 2018 | Sakshi Sachdeva

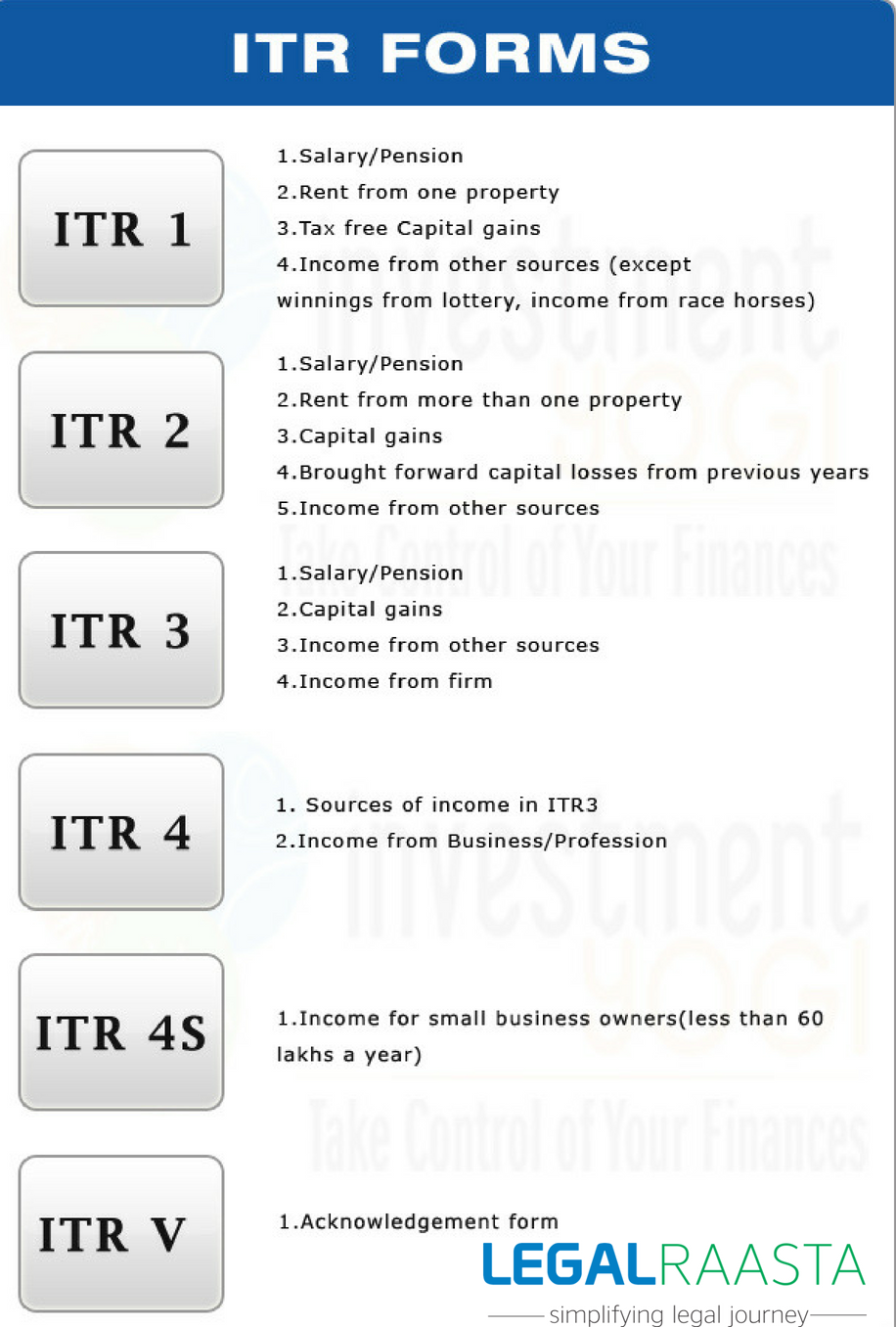

Changes in ITR forms- recent update a...

INTRODUCTION The income tax department of the government of India keeps an eye on every taxpayer. The overall summary of incomes and the amount of...August 20, 2018 | Sakshi Sachdeva