Audit Report Format: Types, Responsibilities of Auditors

Introduction

An audit report is a document prepared by the Auditor of the Company who must be a practicing Chartered Accountancy. The audit report format guides the auditor to make the report according to the government rules. All companies registered in India are required to appoint an Auditor and get the accounts audited each year. The audited financial statements then are filed by the Company’s Directors along with the Directors report as the company’s annual filing with the Ministry of Corporate Affairs.

An audit report format with an auditor’s opinion is released by the auditor after verification of the accounts, financial and operational performance of the company. The audit opinion of the auditor can be unqualified, qualified, adverse or disclaimer of opinion. An unqualified audit report submitted by the auditor of the company means that the Auditor has verified and accepts the financial statement prepared by the Company. A qualified opinion means when the Auditor of a company after verifying the accounts does not agree on some information presented in the financial statements prepared by the Company.

Types of the audit report format

Unqualified opinion

An unqualified opinion in an audit report format indicates that the information being presented in a company’s financial report by the auditor is clean. An unqualified opinion shows that the audited financial statements can be assumed to be free from misstatements.

Qualified opinion

An opinion presented in a qualified audit report format is similar to an unqualified opinion. However, the auditing body cannot present an unqualified opinion for several reasons. One reason can be that the company does not present its financial records in accordance with generally accepted accounting principles (GAAP) and the accounting standards approved by the government.

Disclaimer opinion

An Auditor gives a disclaimer report when they are unable to express a definite opinion. This can happen due to the lack of proper maintenance of financial records or due to the absence or insufficient support from the management. For instance, an auditor may not have the opportunity to fulfill tasks that are crucial to the audit report process, it can be observing operational procedures or reviewing particular procedures.

Adverse opinion

Issuing of an adverse opinion indicates that there has been a gross misstatement and, possibly, fraud, in the preparation of the company’s financial records. Adverse opinions show the company’s records are not being prepared in accordance with Generally Accepted Accounting Principles. Financial institutions or investors reject the financial statements with adverse audit opinions

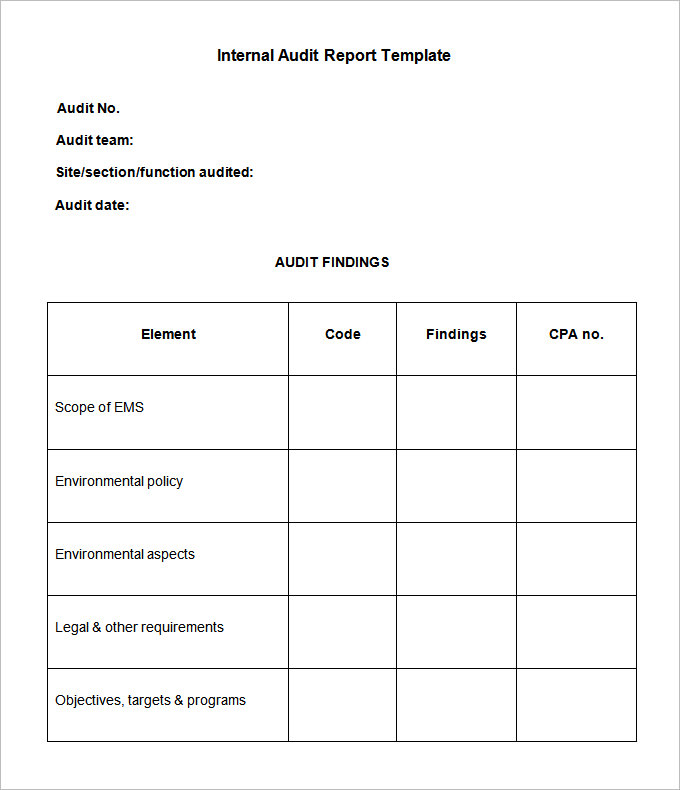

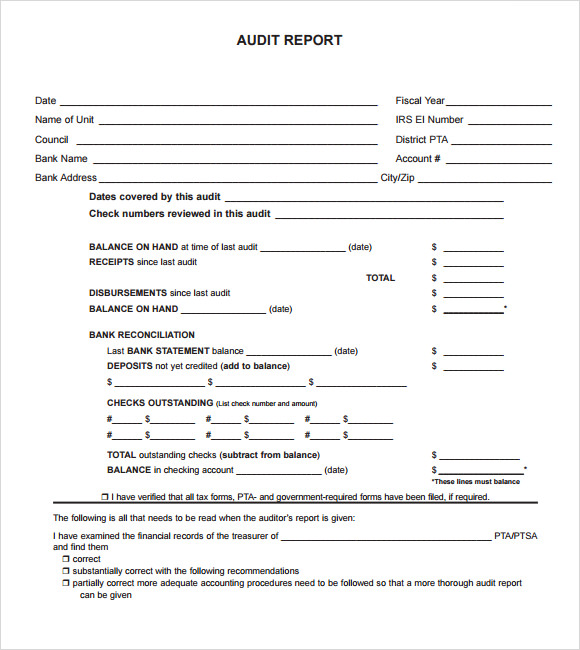

Templates for audit report format

Responsibility of Management for the Standalone Financial Statements

The Board of Directors of a company are responsible for the matters which are there in section 134(5) of the Companies Act 2013. Preparation of these standalone financial statements gives a true and fair view of the financial position, and cash flow of the company in accordance with the Generally Accepted Accounting Principles. Also, read on the procedure of striking off a company under the Companies Act 2013.

The responsibilities of the management also include maintaining adequate accounting records. in accordance with the provisions of the Company Act for safeguarding the assets of the Company and for preventing and detecting frauds and other irregularities. The selection and application of appropriate accounting policies.

Making judgments and estimates that are more reasonable and prudent. Designing of the financial records, its implementation, and maintenance of adequate internal financial controls that were operating effectively for ensuring the accuracy and completeness of the accounting records. Accounting records and bookkeeping is relevant for the preparation of the statements and presentation of the monetary statements that give a true and fair view and are free from all material misstatement, whether due to fraud or error.

Auditors Responsibilities

An audit report format involves performing procedures for obtaining audit evidence about the amounts and disclosures in the financial statements of the company. The procedure of auditing of company records depends on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error.

During the risk assessments, the auditor shall consider the internal control relevant to the Company’s preparation of the monetary statements that give a true and fair view in order to design the audit procedures that are appropriate in the current circumstances, but not for the purpose of expressing an opinion on whether the Company has in place an adequate internal financial control system over monetary reporting and the operating effectiveness of such controls.

An audit shall also include the evaluation of the appropriateness of accounting policies used by the company’s auditor and the reasonableness of the accounting estimates made by the Company’s Directors, as well as the evaluation of the overall presentation of the financial statements.

For more details related to audit reports, accounting and bookkeeping services, and we also have refined accounting software. You can visit our website: LegalRaasta. So, give us a call at 8750008585 and feel free to send your query on Email: contact@legalraasta.com

Related posts