Steps to start BPO in India

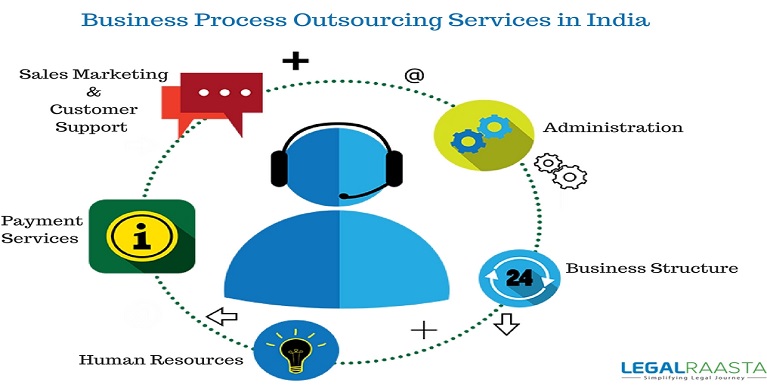

India economy has witnessed a tremendous growth of outsourcing markets since last few years. In order to increase efficiency in business by cutting cost, various multinational and national companies are looking forward to outsourcing services. This outsourcing of business services is done through Business Process Outsourcing Centres, or simply BPO’s.

Not just are they cost effective, but there are several benefits that BPO’s have to their credit. They have wide employment opportunities, they foster our economic, there has been an increase in efficiency due to focus on key areas and much more, which is why this sector is luring in many young entrepreneurs to come up and start their own Outsourcing Centres.

Steps to start BPO:

To start BPO, it is mandatory for the entity to be incorporated as a private limited company. So all those entrepreneurs aiming to start up a BPO or call centre must incorporate a private limited company.

Registration: The very first step in this direction is to come up with a business structure. The registration process varies across various entities and type of outsourcing you wish to opt for, it may either be a Domestic BPO or International one. You need to register with NASSCOM.

Tax certification: It is essential to get a Tax certificate which enables you to pay the required tax set by the authorities.

Required resources: Obtaining the required resources is also one of the important step wherein equipment, locations, servers are all determined.

Hiring Personnel: Hiring the right personnel to execute the operations is also one of the essential steps in this pursuit.

Now the Legal obligations, Yes, Licenses!

There exist several legal formalities as well which are:-

1. OSP registration: Since the call centres are registered under the OSP category as defined in NTP’99, it is a must for them to obtain an OSP license.

Another service provider registration, which is the must for all service providers, providing services in telebanking, telemedicine, tele education, call centre and other IT enabled services. To obtain an OSP registration, an application must be made to the Department of Telecommunication in the prescribed format along with supporting documents, which are:

• Certificate of Incorporation issued by the Registrar of companies

• Memorandum and article off as association

• Board resolution or Power of attorney authorising the authorised signatory with attested signatures.

• Shareholder’s fund with equity details

• Demand draft of INR 1000/- drawn in the name of Pay and accounts officer, DOT, towards the processing fees.

• A number of seats in the call centre.

• Schematic diagram of the call centre layout with equipment details.

• Address of all locations connected with leased lines or where incoming only PSTN lines are terminating.

• The bandwidth of the leased lines.

• After the authority makes necessary verification, it grants the license valid up to 20 years from the date of such application

2. Service tax registration.

Service tax is one of the widely levied forms of tax on service provided across India. Service tax 12.36% must be levied on domestic customer and should be remitted to the government. For this purpose, a registration as a service tax provider id is mandatory under the law.

How can LegalRaasta ease you in?

Now does all of these obligations and compliances seem too much or are getting on your nerves? You now do not need to worry when your legal aid is right there by your side. We at LegalRaasta are happy to help. Here’s how?

We at LegalRaasta strives to reduce the cumbersome procedure to its minimal by removing the intermediaries.

By way of downloading the application form, and filling in your details along with the scanned copy of yourself attested aforesaid documents. After receiving all your documents, our experts will start working on your license and wherein upon the necessary checks and verification by the authorities, you will be provided with your license and you’re good to go.

When in doubt hit the link www.legalraasta.com where all your legal woes are sorted upon.