ESOPs and it’s benefits to startups

Introduction to ESOP

Employee Stock Option Plans or ESOP for short have been used by many companies to great avail. There are stories of companies eg. Infosys using ESOPs to create exceptional wealth and loyalty among employees. One such story involves a Driver exercising their right to cash out ESOPs and becoming a millionaire in the process. Yes, you read it right! A driver and a millionaire in the same sentence.

Another story follows Google hiring one of our Indian fellows with an annual package of 1.2 Crore rupees. However, the conditions of his employment stipulated that half his salary was in the form ESOPs. Startups can use these plans after registering their company to attract and retain talented employees who can contribute towards the swift growth of the organization.

What are ESOPs?

Technically speaking, ESOPs are the plans in which the employees get the right to buy a fixed amount of shares(determined by Employer) at a predetermined price in lieu of their salaries. Employees can only exercise the right to buy shares after a fixed period of time known as the Vesting period. Offering the prospects of being part of the big fortunes of the company gives a sense of ownership to employees. Tapping into this sense of ownership employees are willing to work harder. This generally occurs because employees realize their financial growth is directly linked to the company performing well.

How do ESOPs work?

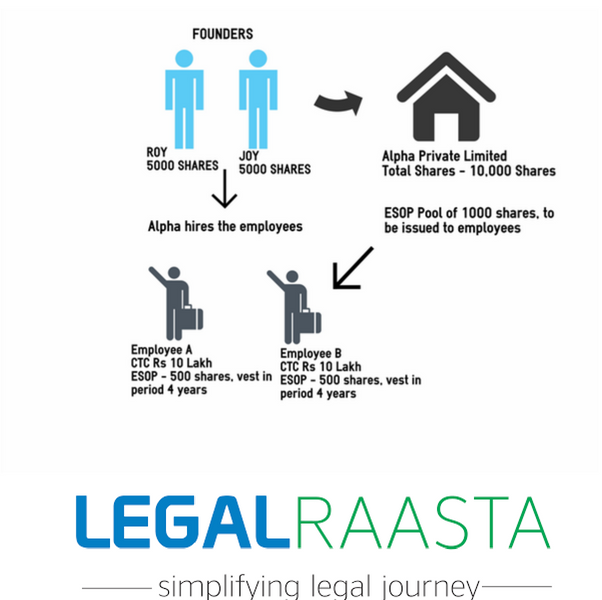

Let’s take an example of Alpha Private Limited.

Alpha Private Limited is a recent startup and is looking for talented employees. The employees demand a remuneration of Rs. 15 lakh per annum as they are experts in their area. The company, however, can only afford to pay Rs. 10 lakh per annum. So in a pursuit to not lose two experts, the company allocates ESOPs to both employees with a vesting period of 4 years and hires them with 10 LPA salary.

The company did not lose two great prospective employees who will definitely accelerate the growth of the company and they did so while only investing the least possible amount of current assets. The early-phase start-ups are incapable of paying highly competitive salaries and hence use ESOP as a tool to retain employees. ESOPs are basically a promise to the employees that when the company has grown because of your efforts you will have a right to be a part of its fortunes.

Who is Eligible for ESOP?

According to the Companies Act, 2013 under Section 62(1)(b) provides that a company may, subject to compliance with conditions as prescribed under the Rules (in case of unlisted company) and SEBI Regulations (in case of listed companies), offer shares to the employees under a scheme of employees’ stock option.

With accordance with the Companies (Share Capital and Debentures) Rules, 2014 only the following employees are NOT eligible for ESOP

- Employees belonging to the promoter group of the company

- A director who either himself or through his relative or through any body corporate, directly or indirectly, holds more than 10% of the outstanding equity shares of the company.

ESOP benefits for Startups

ESOP is a great tool to align the objectives of new prospective employees with the company shareholders i.e. Growth of the Company. Early-phase startups are almost always at a dearth of resources and the prospect of future resources can act as not only a retention tool but also as an attraction tool for future employees.

Let’s look at some of the benefits ESOPs have for startups.

- Employee Attraction and Retention- As previously mentioned, ESOP are a way to instill a sense of ownership in the employees. This also motivates the employees to stay associated with the company for longer durations. The early phases of startup need to retain and motivate employees to work hard and accelerate the growth of the company. ESOP ensures to the employees that they are also a part of the profits and revenue the company is generating.

- Motivational Push- As an employee starts working for your company and sees the growth of the company they start to realize the further the company progresses, the more the value of their individual shares. This often offers as a way of motivating the employees to start putting in extra hard work and going the extra mile to ensure the company’s share value rises as does their own personal share value.

- Cost Control – Companies offer ESOPs as compensation for cash rewards and bonuses. Early-phase startups are most of the times not in a financial position to afford highly competitive salaries. However, offering ESOP fulfills the promise of providing exciting compensation for the employees without compromising present cash supply and financial resources. This leads to effective cost control in the present scenario where every penny matters.

However, despite all their cost-cutting and employee retention qualities, there are some drawbacks and challenges to implementing ESOPs.

Challenges to ESOP implementation

- Trust Issues- ESOPs are a gamble for employees, a game of chance, sacrificing immediate compensation elsewhere to just a promise of a multitude of wealth in the future. A promise of shares before the company has gone public sounds like a very hollow promise. In such cases, if prospective employees are not convinced or are hard to convince about the direction and growth of the company many talented employees could slip from the fingers of the founders which could hurt the company even more.

- Taxation- Oh did we forget to mention taxes are involved? Let this serve as a disclaimer to all who are enthusiastic about their stock options at their new company. ESOP come with taxation rules involved. After the vesting period, when it’s time to exercise your right to the stocks of the company, a tax is liable which is the difference between fair market value share and the exercise rate(Rates agreed for buying shares at the time of employment). Employees are also to pay a Capital gain tax at the time of selling of said bought shares. It’s the differential amount of selling price and fair market value.

Things to keep in Mind for ESOPs

- Proper Documentation- Employees should ensure that the claim for being offered ESOPs in lieu of salary should be agreed to only in the presence of proper documentation.

- Exit Mechanism – All current and possible future prices of shares should be considered and the option of provisions like promoter buyback in case listing of the company is delayed.

- Taxation – As mentioned above, the allotment of shares comes with taxation as if they were salary/perquisite and employees will have to pay 30% flat on the difference on fair market value share and exercise price.

Conclusion

After an extensive study into ESOP’s exciting prospects and startups using it as a fashionable trend to include employees in the growth of the company sounds intriguing. For early-phase startups, ESOPs have come forward as a great cost-cutting tool and the benefits have reaped humungous rewards for many private limited companies among others.

At LegalRaasta we specialize in company registration for startups. If you are just starting out with forming your company, There are many things to consider to ensure smooth day-to-day operations. These include documentation, Compliances as well as Business Income Returns Filing.

Shoot us an e-mail at contact@legalrasta.com or ring us up at +91-