LegalRaasta is an online portal for simplifying legal compliances for Individuals as well as businesses. We help provide the quickest and most efficient legal registration for businesses like GST consultation, Food License, as well as, Company Formation with Trademark Filing. In addition to this, our services extend to efficient tax management such as GST returns, and Income Tax Returns ITR. Call +91-875-000-8585 with your requirements

IceGate: e-Commerce Portal of Central Board of Excise and Customs

ICEGATE PORTAL

ICEGATE, full form Indian Customs Electronic Commerce/Electronic Data Interchange (EC/EDI) Gateway is a portal for e-filing services for the clients of Customs Department (collectively called Trading Partner). The clients of the customs department could include trade and cargo carriers as well. As of this 2019, 24000 users are registered with ICEGATE serving over 6.72 lacs importer/exporters. The e-commerce Portal of Central Board of Excise and Customs links about 15/broad type partners with custom Electronic Data Interchange through message exchanges enabling faster customs clearance. This also facilitates Export Import Trade. Also, See Import Export Code.

The Icegate infrastructure project has been put up with an aim to fulfill the department’s Electronic Commerce and Electronic Data Interchange, along with data communication requirements. The portal allows for the delivery of a host of services including the e-filing of the Bill of Entry (Import Goods Declaration), Shipping Bills (Export Goods Declaration) and related messages between the Customs and Trading Partners. The facilities used for communication include E-mail, Web-upload, and FTP which are among some of the most commonly used protocols on the internet.

Airline and Shipping Agents file manifests through the internet by means of the facilities. Custodians and Cardo Logistics operators interact with customs EDI through the IceGate portal for cargo and logistics related information. In addition, data exchange also occurs between the Customs and various regulatory and licensing agencies such as DGFT, RBI, Ministry of Steel and DGCIS. The National Import Database and Export Commodity Database (ECDB) for Directorate of Valuation are also serviced via the ICEGATE portal.

The electronic documents/messages being handled by the ICEGATE are processed at the Customs’ end by the Indian EDI System (ICES) running at 134 customs locations. The e-filing services are also complemented by other services like e-payment, online registration for IPR such as trademark filing, Document Tracking status at customs EDI, IE Code status, Online verification of various documents. PAN Card based CHA data and links to various other important websites such as DGFT, CBEC.

In addition to the wide array of services under the portal, ICE GATE also gives a 24×7 helpdesk facility to their partners. Digital Signatures are used on the documents to ensure secure filing.

ICEGATE Vision and Mission

Vision

Icegate’s vision is to provide an efficient and Transparent mechanism for the collection of indirect taxes and enforcement of cross border control with a view to encouraging voluntary compliance.

Mission

Icegate aims to deliver high-performance and excellence in the implementation, as well as, formulation of Customs, Central Excise, and Service Tax laws and procedures. The goals Icegate wishes to accomplish with the same are as follows:

- Realizing the revenues in a fair, Equitable, transparent, as well as, efficient manner.

- Administering the Government’s economic, taxation and trade policies in a pragmatic manner

- Facilitating Trade and Industry by streamlining and Simplifying Customs, Central Excise, and Service Tax procedures

- Helping Indian businesses to enhance their competitiveness.

- Ensuring Control on Cross Border movement of goods, services, and Intellectual Property

- Cultivating a climate of voluntary compliance by means of delivering information and guidance

- Battling Revenue Evasion, Commercial Frauds, and Social Menace

- Supplementing the efforts in ensuring National Services

What is ICES?

ICES stands for the Indian Customs EDI System. There are 134 major customs locations where ICES is handling close to 98% of India’s International Trade in terms of Import and export consignments. Some salient features and aspects of ICES include:

- Internalizing the automation of Custom House for a comprehensive, paperless, automated customs clearance system which makes the functioning of Customs Clearance transparent and efficient

- Real-Time electronic interfacing with regulatory agencies in charge of clearance of customs of import and export cargo via ICEGATE.

- The ICES has been designed to transact customs clearance related information digitally using Electronic Data Interchange (EDI). Documents are processed online along with live customs clearance is done.

EDI Customs Trading Partners: Overview

[fusion_table fusion_table_type=”1″ hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

| EDI Trading Partner | NAture of Information Exchanged | No. Of Messages |

|---|---|---|

| Importers/Exporters/CHA | Bills of Entry/ Shipping Bills and related messages | 13 |

| Airlines / Shipping Agents / Shipping Line | Manifests and cargo logistics messages | 26 |

| Air Custodians | Cargo logistics messages | 9 |

| Sea Custodians | Cargo logistics messages | 18 |

| ICDs | Cargo logistics messages | 6 |

| Banks | Financial messages – duty drawback disbursal and customs duty payment | 9 |

| DGFT | License, shipping bills, and IE Code data | 13 |

| RBI | Forex. Remittance data | 1 |

| DGCIS | Trade statistics | 2 |

| Directorate of Valuation | Valuation data | 2 |

[/fusion_table]

Three Systems are major Components of Indian Custom automation

- The ICES running at 134 locations. ICES has to automatically receive and process all incoming messages. ICES generate all outgoing messages automatically at the appropriate stage of the clearance process.

- ICEGATE is the interface of ICES with the external world for customs clearance related messages and sharing of trade Statistics/Customs clearance data with licensing and regulatory agencies such as DGFT, DGCI&S, Ministry of Steel,RBI etc.

- RMS(Risk Management System) is the 3rd component which facilitates the compliant trade segregating the transactions requiring deeper scrutiny by customs officers.

ICEGATE REGISTRATION PROCEDURE

In order to register yourself on the ICEGATE portal, you have to follow the procedure as below

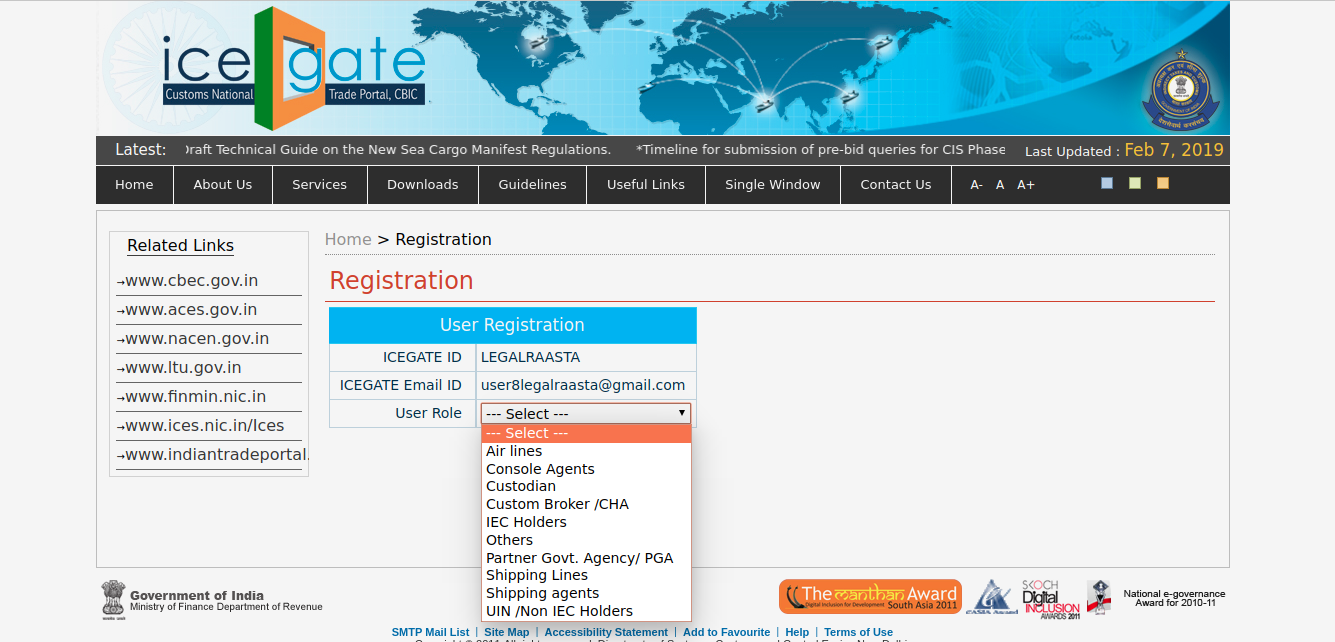

Step 1: Head on over to the ICEGATE User Registration

Step 2: Enter your desired icegate ID and you e-mail address

Step 2: Select Your Role

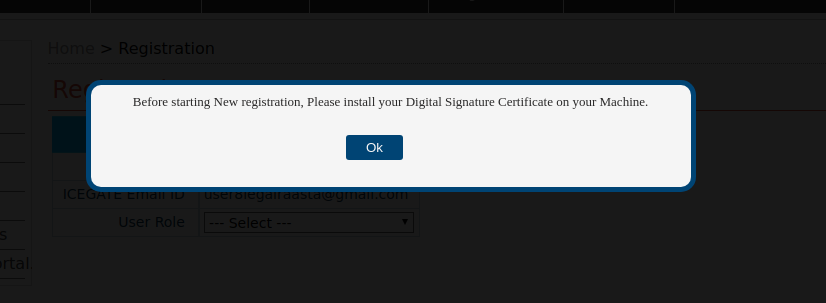

Step 3: As soon as you fill in your role the website will ask that you upload your digital signature on the machine before proceeding

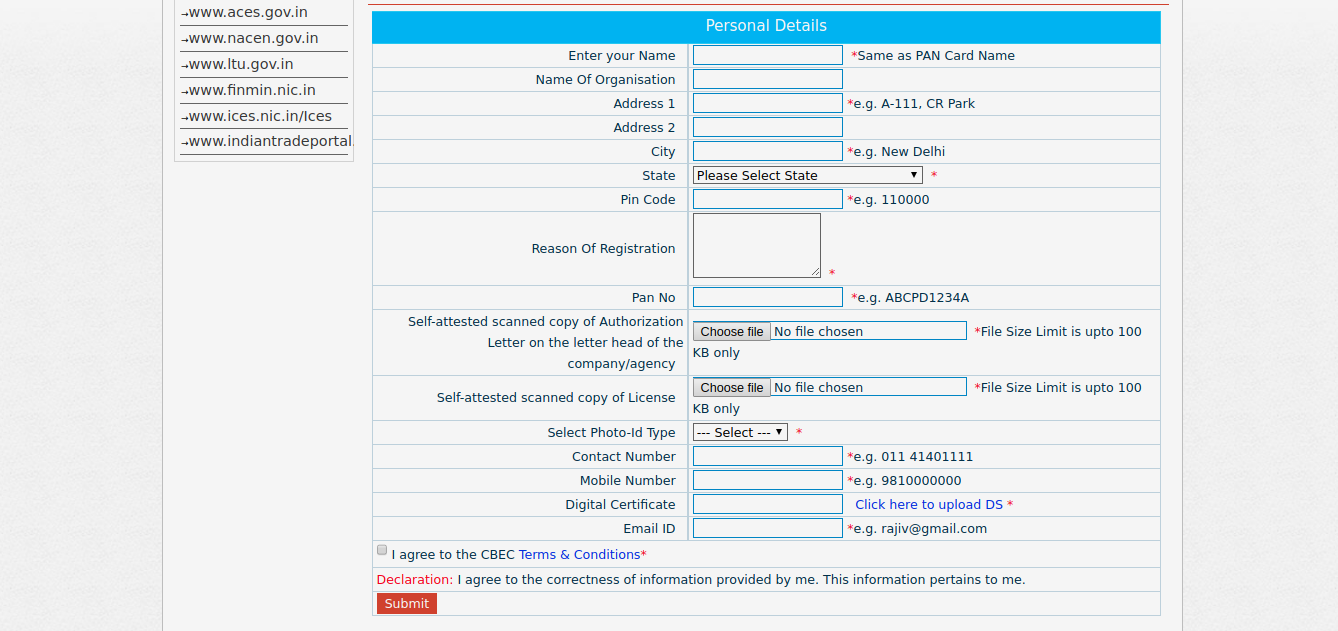

Step 4: As Soon as you Click OK, An Application Form will open where you will need to enter the personal details of yourself and the business, Fill up your details, Click Go and You will be registered.

Banks Accepting Payment with ICEGATE (e-payment)

- State Bank of India

- Punjab National Bank

- Bank of India

- Indian Bank

- UCO Bank

- Union Bank of India

- Bank of Maharashtra

- Corporation Bank

- IDBI Bank

- Bank of Baroda

- Canara Bank

- Indian Overseas Bank

- Central Bank of India

- Vijaya Bank

Functions and Services of ICEGATE

The ICEGATE is a portal which has facilitated a lot of services to ease the life of businesses in India. Here are some regulatory functions as well as services of the portal:

Regulatory Functions

- Levy and Collection of Customs and Central Excise duties and Service Tax

- Registration and Monitoring of units manufacturing excisable goods and service providers

- Scrutiny of declaration received and returns filed with the department

- Combating smuggling and other unfair practices like an evasion of duties and service tax

- Border Control Implementation on goods and Conveyances

- Clearance, as well as, examination of imported and exported goods

- Export Promotion Measures

- International Passenger and baggage Clearance

- Dispute Resolution via Administrative and Legal Measures

- Refund, Rebate and Drawback Sanctioning

- Arrears of Revenue

- Audit Assessments for Ensuring Tax Compliance

Services of ICEGATE

The ICEGATE Portal broadly provides services in the following verticals:

- Custom House Agent Transaction Services

- Exporter/ Importer E-Services

- Institutional Partners Information, Guidelines

- E-Payment Authorized Bank Partners

As a result, of these service verticals, there are certain service functions that the portal performs which are:

- Information dissemination on law and procedures through electronic and print media

- Empowering filing of declarations, returns, and claims through online services.

- Furnishing information on the status of processing of declarations, returns, and claims

- Assisting the right holders in Protecting their Intellectual Property Rights

- Inquiries of the Public in relation to Customs, Central Excise, and Service Tax Matters

- Providing Customs services such as examination of goods and factory stuffing of export foods at clients’ sites

Benefits of ICEGATE Registration

In being a partner with ICEGATE, there are many benefits an export-import business entitles themselves to. Some of the benefits are as follows:

- ICEGATE helps businesses e-filing both import and export declarations

- Portal permits the customs to respond to exporters and importers after assessing shipping bills and bills of entry.

- Ensuring declarations filed through the digital signatures are allocated by customs, acting as a signatory authority under the Information Technology Act of 2000, will not be invalidated under any circumstance

Grievance Redressal

The ICEGATE claims to be a responsive and taxpayer-friendly department and it has put in place a comprehensive grievance redressal system according to the regulations of which:

- ICEGATE will acknowledge complaints within 48 hours of receiving the complaint and will work towards furnishing final replies within 30 working days

- If final replies cannot be sent in the given timeline, an interim reply will be sent to the aggrieved business

- If no reply is given within the given timeline, Aggrieved can file an appeal with the Jurisdictional Commissioner / Cheif Commissioner.

- Common Complaints and Grievances can also be taken up with the Public Grievance Committee Permanent Trade Facilitation Committee, Regional Advisory Committee and in the Open House meetings

GRIEVANCE REDRESSAL OFFICERS

At the field level: A Public Grievance Officer has been designated in each Commissionerate / Customs House with whom all complaints and grievances can be taken up. The contact details of the Commissionerate-wise Public Grievance Officer are available at www.cbec.gov.in.

At the Board level: Commissioner (Publicity) has been nominated as the Public Grievance Officer for the Central Board of Excise and Customs, whose contact details are indicated below : Address : Directorate of Publicity & Public Relations, Customs & Central Excise, Central Revenues Building, I.P. Estate, New Delhi-110 109 Phone : 011-2337 9331 Fax : 011-2337 0744

About LegalRaasta: