Break-Even Analysis

Contents

The Break-Even Analysis refers to the method adopted by the firms to determine what level of production and sales is to be maintained to ensure that it does not lose money. It is a financial tool, used for economics, business, bookkeeping and accounting. Break-even analysis is a study of the relation between the variable cost, fixed cost, and profits.

In other words, the minimum quantity at which the total costs (fixed and variable) are going to get covered is called as a break-even point. Once you are breaking even, you are neither losing nor making money. Only all your costs are being covered. Beyond this point, any sales would be profit.

Five Simple Situations to use Break-Even Analysis

This analysis is one of the simple Accounting Methods, used during the purchase of plant, machinery or other equipment. It will help you determine, for example:

1. Starting up:

At the time of starting a new business, break-even analysis is a must. It will tell you whether your business idea is viable and force you to research costs and your pricing strategy. It is also one of the Key Factors considered by Venture Capitalists.

2. Launching a new product:

Before including a new product line into your existing framework, it is essential to understand the increase in costs, fixed and variable, that new product will set you back with. It will also help you set prices for the new product.

3. Adding a sales channel:

If you have a shop and want to start selling online, you may want to make sure that the sales would cover the expenses of creating, advertising and maintaining the website, for example. As whenever you add a new sales channel, your costs will change, even if the prices don’t. Else the financial strain could put the rest of your business at risk.

4. Changing the business model:

If you want to switch over your business model, for example switching from exporting goods to selling domestically, you should do a break-even analysis. Your costs would change significantly, break-even analysis will help you figure out the change that you must bring in your prices.

5. Calculating the Contribution of a certain Product Line:

In order to streamline the business activities, you may want to close some product line. Before planning to reduce the number of products, you may want to know how much that product is contributing to your total revenues. Here the break-even analysis can be of use efficiently. The Contribution Margin is the difference between the Sales price and the Variable costs. To calculate the Contribution Margin, any fixed costs are not included.

Why Break-Even Analysis is Used

Due to its emphasis on the Marginal Concept, the break-even analysis is an effective tool for planning and control. The study of break-even points emphasize the effects of additional sales on profits.

- Measuring how the different product lines and processes are contributing to the profit and losses of the firm.

- Estimating the effect of changes in cost on profitability.

- Predict the amount of loss the company can sustain during a recession.

- Its calculation avoids making an over-optimistic forecast about sales.

- The entrepreneur can better understand the importance of keeping the FIxed Costs low so that Break-Even Point can be achieved quickly. The higher the break-even point, the fewer chances of operating the business at a profit over the years.

- A tool for management for planning, testing, deciding, controlling and coordinating business activities.

- Break-even analysis enables to prepare a proper budget of the firm.

- A margin of safety can be known, helping in planning as to how the margin can be increased. The margin of safety is calculated by deducting Break Even Sales from the Actual Sales.

- Focuses entrepreneurs on how long it will take before a start-up reaches profitability – i.e. what output or total sales is required.

Also Read: A Business Guide to Goals, Objectives, and Finding Success

Components to calculate Break-Even Point

The essential parts to calculate break-even point are:

- Total Fixed costs,

- Variable cost per unit,

- Cash Inflow.

Total Fixed costs:

Fixed Costs remain constant, regardless of the quantity produced. For example, rent, salaries, depreciation, energy, and advertising costs, do not change with production volume. They are costs that continue whether any sale is occurring or not.

Variable cost per unit:

Variable cost increases or decreases with the production. It is incurred for selling or producing one additional product or unit. in direct relation to the production volume. It includes the cost of raw material, packaging cost, sales commission, fuel and other costs that are directly related to the production.

Cash Inflow:

Finally, you need to decide the price at which you can sell each of your product or services. You must take into bookkeeping and accounting, the discounts and special offers. This is the average price. Any discounts or special offers will lower this average price.

How to Calculate Break-Even Point

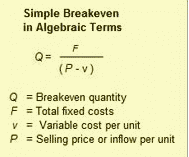

The formula for calculating break-even point is:

Break-Even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

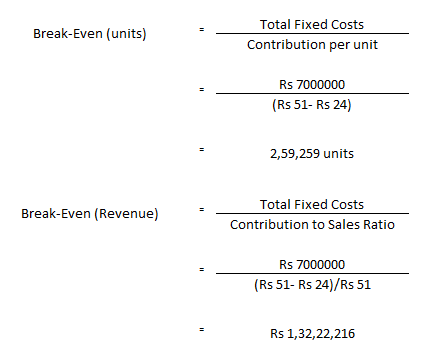

If you have a product, which is sold @ Rs 51 per unit. The per unit variable costs are Rs 24. Fixed costs are Rs 70,00,000.

So here is the break-even point in terms of units and sales revenue:

Controlling Break-even point

Controlling your company’s break-even point would invariably result in keeping a firm check on the Fixed Costs, finding and implementing ways to reduce the amount the variable costs per unit and by improving the sales. You can also increase sale price per unit so long as the quantity does not decline.

- Cost Review: A frequent analysis of all the costs, fixed and variable, will result in decreasing and eliminating extra costs. This will increase the margin and reduce the break-even point.

- Usage of Discount offers: Exactly calculate the actual gain received by using these sales enhancing techniques. This way you can use the various promotional strategies effectively.

- Usage of Technology: Implementing newer technology would mean in increasing capacity. And better business efficiency.

- Innovation: A process might be redesigned to provide efficiency of costs. A product can be improved to include more saleable features. This will generate additional revenue.

- Contribution Analysis: You take care of the product margins and tend faster to any changes in the sales of products that make better contributions to the turnover.

- Reduce Fixed Costs: When an activity consists of high fixed cost, you may try to outsource such activity, if possible. Even if it increases your variable costs, you only pay for what you use, as much as you use. So if your sales lag, your profitability doesn’t decrease. This can be useful up to a certain extent only.

Benefits of Break-Even Analysis

Business Funding: If you want to take a loan to fund your business or its expansion, you would need to prove that the business idea is profitable. So break-even point would be the key component of your presentation.

Cost control: The break-even analysis can be used to detect some hidden jump or fall in costs that might have, otherwise gone unnoticed. To figure out the break-even point the accounting companies consider every single financial commitment. Further, as you need to consider all the costs, you will include even those fixed assets that may be low-cost or whose costs are not known.

Price smarter: A break-even analysis will help you price your products better. You will be able to better predict how the changes in sales prices, will alter your profits.

Production Planning: You will be able to calculate the optimum level of production so that you can achieve maximum profit without increasing the price.

Make or buy decision: In case you are considering an option of setting up a supporting product line that helps you during manufacturing your earlier product. Or whether to buy this product from outside. This will help you work out the course of action best suited for the purpose.

Efficient Use: Any asset that is costing more and is adding significantly to the costs of your business, without adding value to the product. You will be forced to reconsider its place in your business. This will help you determine the unused capacity of an asset and show the maximum profit that can be generated from its usage.

Product-wise Contribution: You can realize the contribution being made by each product line. You may consider increasing the capacity of some business operation or closing some other one. This will have a major effect on your profitability.

Setting Realistic Targets: You will have an estimated duration of how long it will take before your start-up reaches profitability. What total sales is required to reach the break-even point etc is calculated and gives a concrete goal to work upon.

Solid Business Planning: Calculating the Break Even Point is easy and quick. The decisions made through these are tangible and fact-based, not estimated.

Conditions of uncertainty: The break-even analysis helps with financial management by providing information deducted using factual methods.

Keep the risk in check: You will know whether or when to avoid implementing something new. It helps you avoid risks of failure and/or limit the effect it can have on your business.

Conclusion

All business owners desire to know how much sales they need to achieve to realize a profit. The break-even analysis helps them make important business decisions to achieve their desired income. Understanding break-even point and the steps required to manage it can improve return in your investment.

You can take help of our Bookkeeping Services to have a more accurate analysis and pinpoint the areas due to which the performance is sliding down. Effectively use our Accounting Software to create professional invoices, track expenses and calculate taxes. You can easily spare time to manage your budgeting, forecasting efficiently. We at LegalRaasta are devoted to providing best and beneficial legal advice. You can drop a mail at [email protected] or call us at +91 8750008585.

You can download and use our App to manage business accounts, filing GST or IT returns or simply raise loans for expansion.

Related Articles:

Concept of Accounting standards

Startup India: Benefits of the Government Initiative for startups

Startup Funding Options: How to raise capital for your Startup