Startup Funding Options: How to raise capital for your Startup

Startups

Every big company has humble beginnings and starts with a BIG idea, some start in a garage, some in an abandoned plot and some in a studio apartment. Individuals with an entrepreneurial bent of mind are the ones who change how businesses function and how people go about their day-to-day activities. Innovating, creating and discovering new solutions to complex problems of the society is what entrepreneurs live and die for. The rush of running on your business is the only one which a true entrepreneur can explain. However, once the company registration and related procedures like GST enrolment and intellectual property protection like Trademark Registration are done, it is time to start your operations and these require capital. In order to raise capital for resources of a newly formed business venture, there are many techniques business owners can use, let’s look at some of these startup funding tricks.

Also Read: Company Incorporation Procedure India 2018

KickStarting Startup Funding

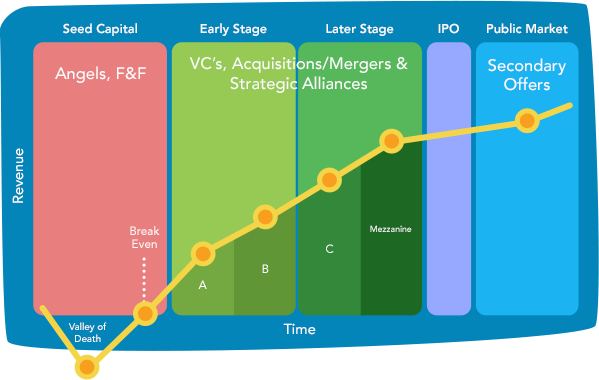

It has been stipulated that more than 90% of businesses fail in the first year of their operations. This failure can be attributed to a multitude of reasons but one of those is the lack of capital or lack of working capital for businesses. Initially, the startup will raise some funds and invest the resources in the company and the returns will not be as much as the resources invested. Therefore, there will be a loss in the beginning. This infamous zone is called the “Valley of death for startups” this is where most startups fail. However, if a venture makes it through that, there are more chances of success.

At every new stage that the companies go through, the only questions a business owner has on his mind is, How will I finance this? Money is and will forever remain the bloodline, the heart, and soul of business, driving it forward when present or lack of it causing problems to the firm. So, let’s discuss the ways in which a positive startup funding can skyrocket your business to new heights of success.

10 Startup Funding Techniques

There are 10 sure shot techniques by which you can fund your entire startup to accelerate operations at the scale at which you desire. Although there is no one path for startup funding you can use a variety of combinations of the below-mentioned techniques in order to provide working capital for your company.

Bootstrapping

Bootstrapping also known as self-funding is basically a startup funding technique which entails getting the working capital for the firm by self. In bootstrapping the concerned business owner has to get the funds via their savings or even through investments via friends and family. The process of raising capitals from friends and family is easy as it has lesser compliances. There are many upsides to raising capital for your firm by the means of bootstrapping. Some of these include:

- High Focus on revenue

- Time-saving by avoiding extra efforts on Fund Raising

- You are not answerable to a board or others

- Freedom for Organic Growth

- Working on your TRUE interests

- Leverage for future fundraising

In today’s the world of Angel’s Investors, VC Firms and loans, government schemes etc. the CEO of GoPro ( wrist-bound, rough-and-ready cameras) Nick Woodman still believes that bootstrapping is the best way for raising funds for your venture.

Nick Woodman, The Highest Paid CEO of 2014, believes bootstrapping is the best way for Startup Funding

Nick Says ” The slow bootstrap worked really well [for GoPro], and the smoke-and-tires approach worked for Pebble. … As long as you can bootstrap not at the sacrifice of competitive advantage, bootstrapping is a really powerful thing because it allows you to be totally devoted to your vision.”

Bootstrapping can, however, put a stretch on your resources and would leave you with very little revenue

Crowdfunding

Crowdfunding has emerged to be one of the newest and innovative ways to raise funds for a particular business venture. Crowdfunding is basically a startup funding technique which involves taking a loan in the form pre-orders, contributions, an investment which covers manufacture costs of the products/ resource purchasing for the delivery of services after the production stage.

In this strategy, the startup creates a buzz for the products/services and make realistic promises of the firm wishes to achieve with the funds provided to them by the crowd, how they plan to turn the venture profitable. The best thing about crowdfunding is that it can also generate interest and hence helps in marketing the product alongside financing. This means professional investors and bankers are removed from the equation. This means creating a buzz of your unique innovation that it connects with the Average Joe of the society.

Creative campaigns are shelled out by companies in order to crowdfund their ventures. Here’s an example of crowdfunding appeal for an electronic bike called MATE.

In order to do crowdfunding for your venture, you need to sign up with some of the world’s most renowned crowdfunding platforms. Some of these are as follows:

Crowdfunding is a very competitive marketplace for earning the funding for your business venture. Your business is only likely to get any amount of funding if your business plan, as well as projected product/ service delivery is excellent and exceptionally unparelled.

Angel Investments

Angel Investors as the name suggests, are investors who are kind enough to invest with their surplus money and resources in order to help your business venture succeed. These are investors with a keen interest in investing in some of the most innovative and interesting projects.

Angel investors have helped to start up many prominent companies, including Google, Yahoo, and Alibaba. This alternative form of investing generally occurs in a company’s early stages of growth, with investors expecting an up to 30% equity. They prefer to take more risks in investment for higher returns.

Like crowdfunding, There are many angel investing platforms in the country. For example:

However, Angel investors invest a lesser amount of money than venture capitalist firms.

Venture Capital Investments

Venture Capital Investments is one of the fundamental routes that many companies take for raising operating capital for themselves. Venture Capital is when you really bet your venture against the market. Venture Capital or VC is basically a professionally managed fund which is invested by VC firms in companies with high growth potential. VC evaluation of a company is said to be a litmus test for the direction the company is going to take. VC firms provide expertise, mentorship, and also help evaluate the business from sustainability and scalability point of view.

The Venture Capital route of startup funding is most suited to businesses which are out of their initial phase and have the potential for enormous growth in the future. Companies with great prospects and an exit strategy in place such as Flipkart, Uber can gain millions of rupees and invest, network and grow substantially well with that money.

VC companies, however, have a very short-term loyalty period for companies. Ideally, VCs would want to recover their money within a time period of 3-5 years. If your products/service idea is taking longer than the time period.

Business Incubators and Accelerator

Very early stage businesses can consider Incubator and Accelerators as a method for funding their operations and acquiring the resources for production/ service delivery. Incubators are essentially business nurturers which provide shelter tools, training, and network to grow to businesses. The business accelerator is a similar prospect to incubators but it as the name suggests, it is an accelerated procedure, makes businesses take giant leaps of progression. Generally, an incubator program runs for about 4-8 months. The famous TV network HBO also aired a TV show called Silicon Valley which took a gander at the state of affairs of running a business in the Silicon Valley with a bunch of genius computer science engineers in an incubator.

n US, companies like Dropbox and Airbnb started with an accelerator – Y Combinator. Here is a list of top 10 incubators & accelerators in US.

In India, popular names are Amity Innovation Incubator, AngelPrime, CIIE, IAN Business Incubator, Villgro, Startup Village and TLabs.

Raise funds through Competitions

A number of technological CodeSprint tournaments are held all across the world for tech start-ups and other startups to prove their worth and excellence in their field by way of competitions. Winning these competitions funded by some of the world’s biggest organizations could also help get some media coverage for your startup.

TechCrunch Disrupt, one of the worlds biggest startup competitions in the world. These could prove to be a crucial way for startup funding

Some other competitions which are held across the globe for startups to participate in are:

- NASSCOM’s 10000 startups

- Microsoft Bizsparks

- Conquest

- NextBigIdea Contest

- LetsIgnite

Bank Loans

Banks are one of the safe havens when it comes to startup funding for newly formed businesses. Banks can facilitate two kinds of funding for startups: 1) Working Capital Loan and 2) Funding Loan. Loans for Business are a good way to finance the startup if you are very certain of the growth of the startup. Working Capital Loan is basically the funds required to run one cycle of operations up until the revenue generation. The loan limit is decided by seeing the stocks and debtors.

Funding from the bank generally involves the process of sharing the business plans and the valuation details with the banks. Most banks operational in India offer the option for SME finance through various schemes and product schemes giving collateral-free loans to businesses.

Business Loans from Microfinance Institutes

Microfinance Institutes and other financial institutes like NBFCs in India are those institutes which can help you out for a business loan when you don’t qualify for loans via a bank. Microfinance is essentially for those who cannot have access to conventional banking facilities.

NBFCs are those institutes which aim to facilitate loans and other financial services without meeting the legal requirements of a bank.

Check out : Difference between Microfinance and NBFCs

You can also check out MicroFinance Institute Network for more details.

Government Schemes

In order to promote the ease of doing business in India, the government had introduced ₹ 10,000 Crore startup fund in the 2014-15 union budget and has been striving every year to make improvements to the allocation of funds for startup funding facilitation in India.

In addition to this, there have been many schemes and policies issued by the government with regards to the providing working capital to businesses. The Bank of Ideas and Innovations program for promoting and boosting innovative product companies. In addition to this, the government initiated the “Pradhan Mantri Micro Units Developments and Refinance Agency Limited” (MUDRA) starts with an initial corpus of ₹ 20,000 crores in order to extend startup funding benefits to over 10 lakh SMEs.

All a business has to do is share their business plan and once it is sanctioned and deemed fit for a loan. Once sanctioned, you will receive a MUDRA card, it’s like a credit card which can be used to purchase raw materials, other expenses etc.

Also, different states have come up different programs like Kerala State Self Entrepreneur Development Mission (KSSEDM), Maharashtra Centre for Entrepreneurship Development, Rajasthan Startup Fest, etc to encourage small businesses.

SIDBI – Small Industries Development Bank Of India also offer business loans to the companies under MSME registration.

In the US, there is a small business lending fund and a dedicated portal for Government grants available for local businesses.

IF you are compliant with the government eligibility criteria, going through government funding could be one of the best options for startup funding.

Rapid Fire Ways to Raise Capital

If the company is in dire straits and in need of some quick cash, there are some rapid-fire way to raise the capital for the company. Some of these are as follows:

Products Pre-Sale: Selling your products before their initial launch can create a buzz or the company and cause you to gain quick-fire capital for your company. Pre-selling the products can greatly enhance the cash flow of the company and help generate an influx of much-needed revenue which might just help the company with a new wave of growth.

Big name brands such as Apple and Samsung pre-sell their products many times, to incentivize people to buy.

Selling Assets: This is one of those measures a company has to take when the situation is dire and there is a need for urgent monetary resources in the company. It might seem like a very hard step to take but in the long run, it is for the benefit of the company if it helps the company grow.

Credit Cards: Acquiring a business credit card can prove to be very beneficial to the company in order to acquire some immediate monetary assistance. Taking a business credit card can prove to be a viable option for the businesses who don’t have a ton of expenses. Though it should be kept in mind that the interest on the credit cards interest rates could skyrocket and it could lead to a build-up of a lot of debt which can cause troubles to the business legally in addition to tarnishing the credit score of the business.

These were some ways, tips and tricks to get startup funding your business venture deserves. It can be very hard running a business and money, is the oxygen for the running of a business. There are a lot of ways in which companies can raise funds and breathe life into their venture. Use this capital wisely and you could be on your path to success and just around the corner from being a big corporation adding value to the lives of millions of people all around the globe.

About LegalRaasta:

At LegalRaasta, we simplify compliances and we pride ourselves in being a GST Suvidha Provider (GSP) and help you file Tax Returns like GST Returns, Help you with GST Application procedure. We’re a startup-friendly firm and help you get your businesses legal compliance done and dusted so you can start your operations without any worries. We have a state-of-the-art GST software called Taxraahi.

Some of our Standout Services include:

Trademark Filing, Company Incorporation, as well as, FSSAI License.Call +91-8750008585 with your requirements