Changes in ITR forms- recent update as on 9th August

INTRODUCTION

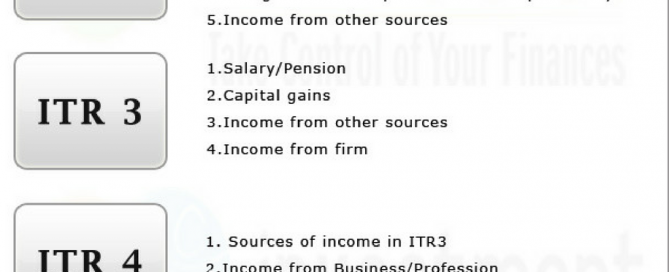

The income tax department of the government of India keeps an eye on every taxpayer. The overall summary of incomes and the amount of tax paid by every citizen to the government of India is something like a report card of a student during a year for the parents. The form that a person […]