Know your TAN

Contents

The Full form of TAN is Tax Deduction and Collection Account Number. It is basically a 10 digit alphanumeric number which is issued by the Income Tax Department. It is necessary to obtain TAN for those who are responsible for TDS (Tax deducted at source) or who is responsible to TCS (Tax collected at source). With this article, you will get to know your TAN in a brief.

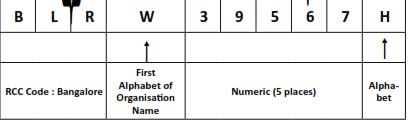

Structure of TAN

Every digit of Tax Deduction and collection Account number denotes different aspects. As we discussed above, TAN is an alphanumeric number in which the first four digits are alphabets, the next five digits are numeric and there is an alphabet at the last. Look at the picture given below and know your TAN more clearly:

Format of TAN

In the above picture, the first three alphabets of tax deduction/collection account number represent the code of jurisdiction, whereas the fourth alphabet denotes the TAN holder’s name with the initial letter of the name. Point to be remembered here is, the TAN holder can be an individual, firm, company etc. The last alphabet of the TAN number is a random one.

For Example, the TAN number of an individual is RXOY 02811 K.

Law requirements

As per the provisions of section 203A of the Income Tax Act, 1961, mentioning the TAN number in all the documents is mandatory. In case, TAN is not quoted then the payments of TDS/TCS will not be accepted by banks. Even, in case of TDS refund, TAN must be quoted. Following are the documents on which TAN must be quoted:

- TCS Statements

- TDS Statements

- Annual Information Return

- TDS/TCS Certificates

- TDS/TCS payment Challan

- Other prescribed documents

It has been mentioned under the same section that the one who deducts or collects tax at source needs to apply for the allotment of Tax Deduction/Collection Number. In case of failure, Rs. 10000 will be imposed as a penalty. To know your TAN more read here: Types of TDS certificate

Documents To be Submitted Along With TAN Application

If you are applying for a new TAN through online mode then the only thing you need to submit is the signed acknowledgment slip if they apply for a new TAN through online mode.

Online procedure for TAN Application

There are generally two options for filing application for TAN. They are:

- Online

- Offline

Given below is the online procedure for a new TAN. All you need to follow the given steps:

STEP 1.

Go to the official website by using the link: www.tin-nsdl.com/index.html

STEP 2.

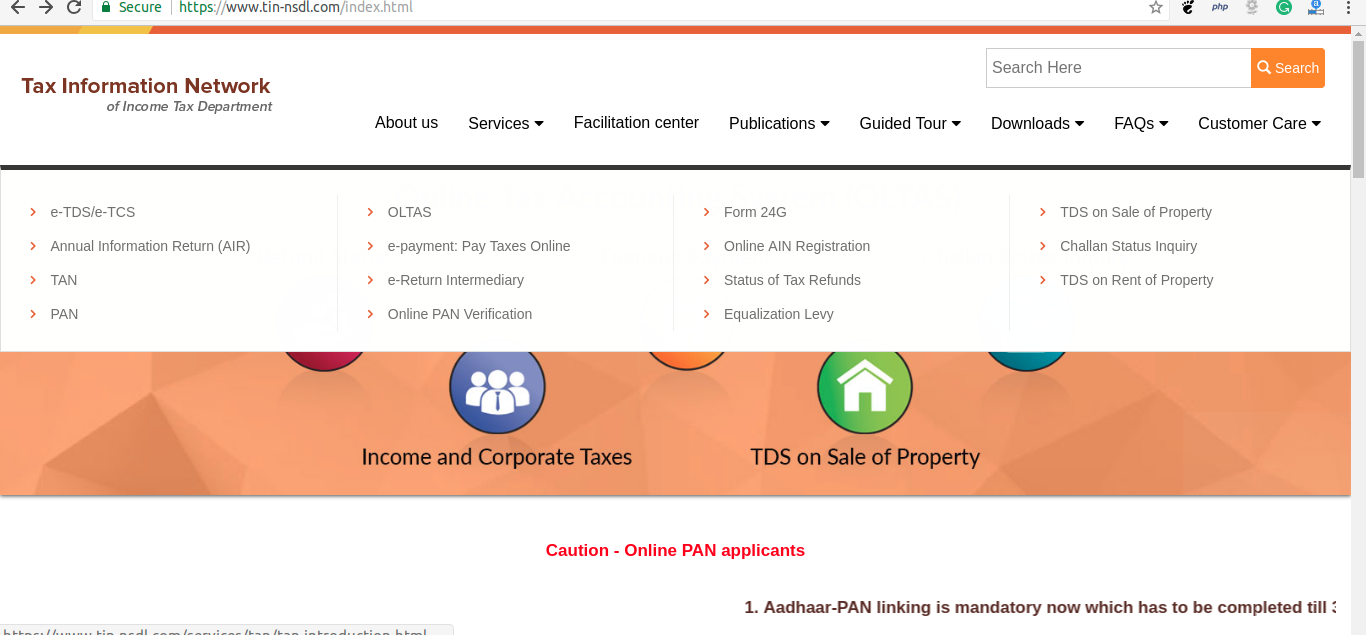

Choose the option ‘TAN’ under the ‘Services’ dropdown.

STEP 3.

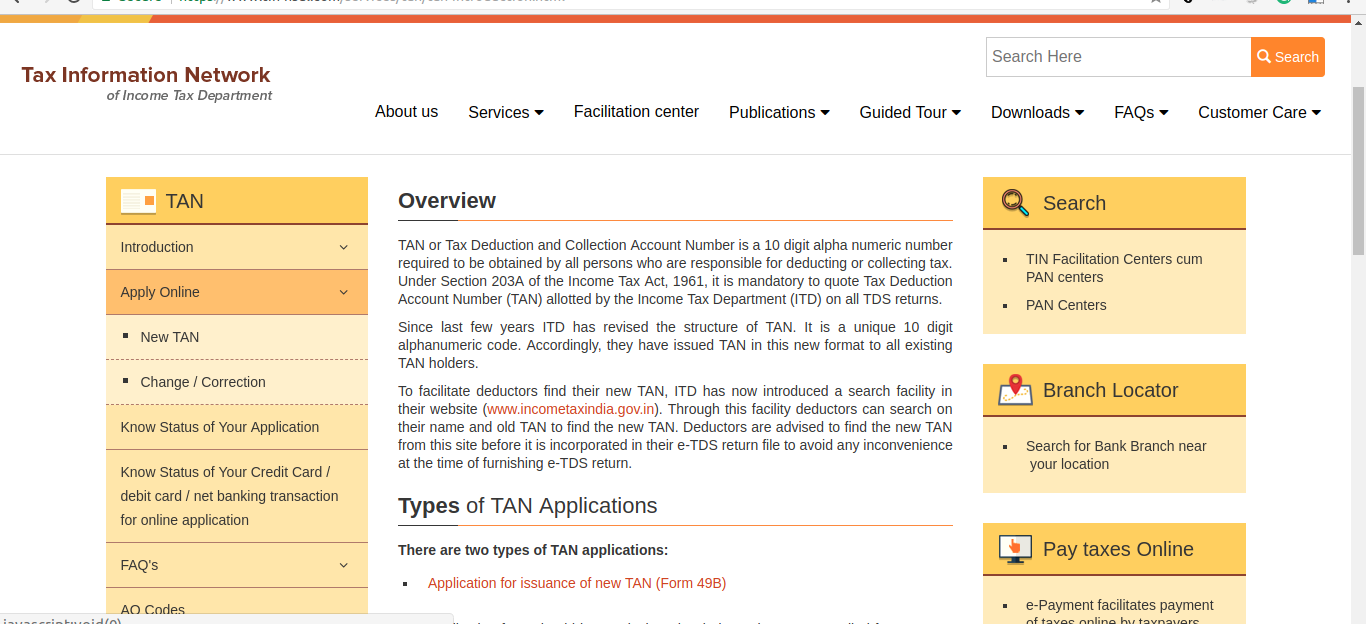

Then, click on ‘Apply Online’ and then choose “New TAN”

STEP 4.

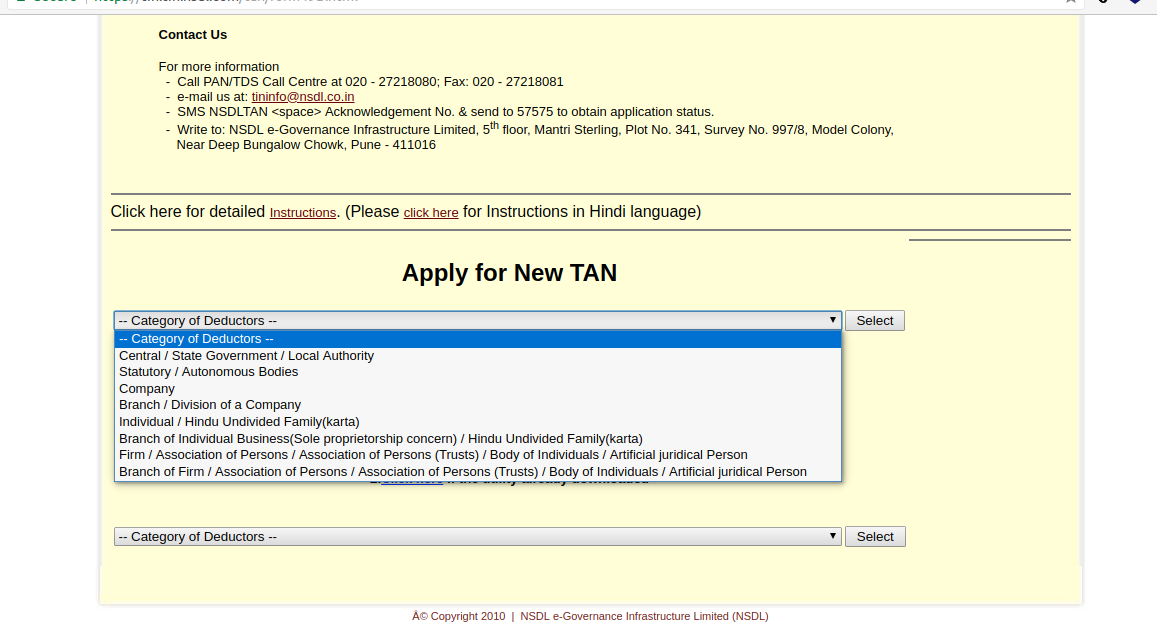

From the given list, choose from the list ‘category of deductors’

STEP 5.

Now, click on ‘Select’

STEP 6.

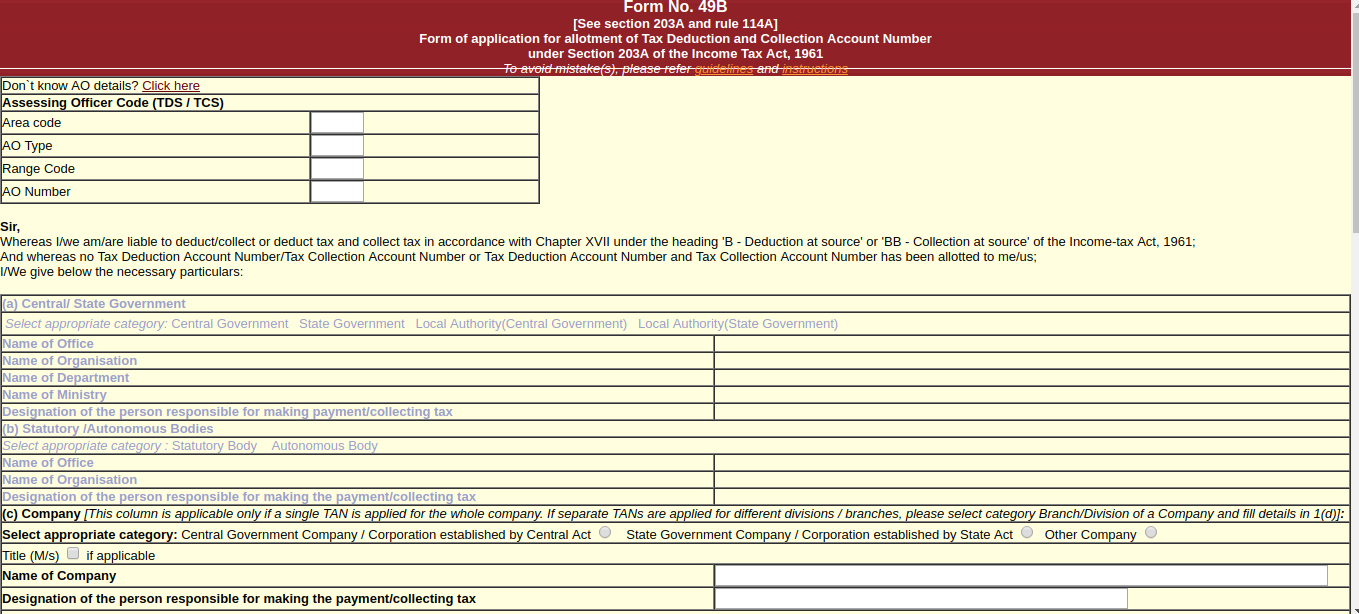

After doing the so, you will be redirected to Form 49B.

STEP 7.

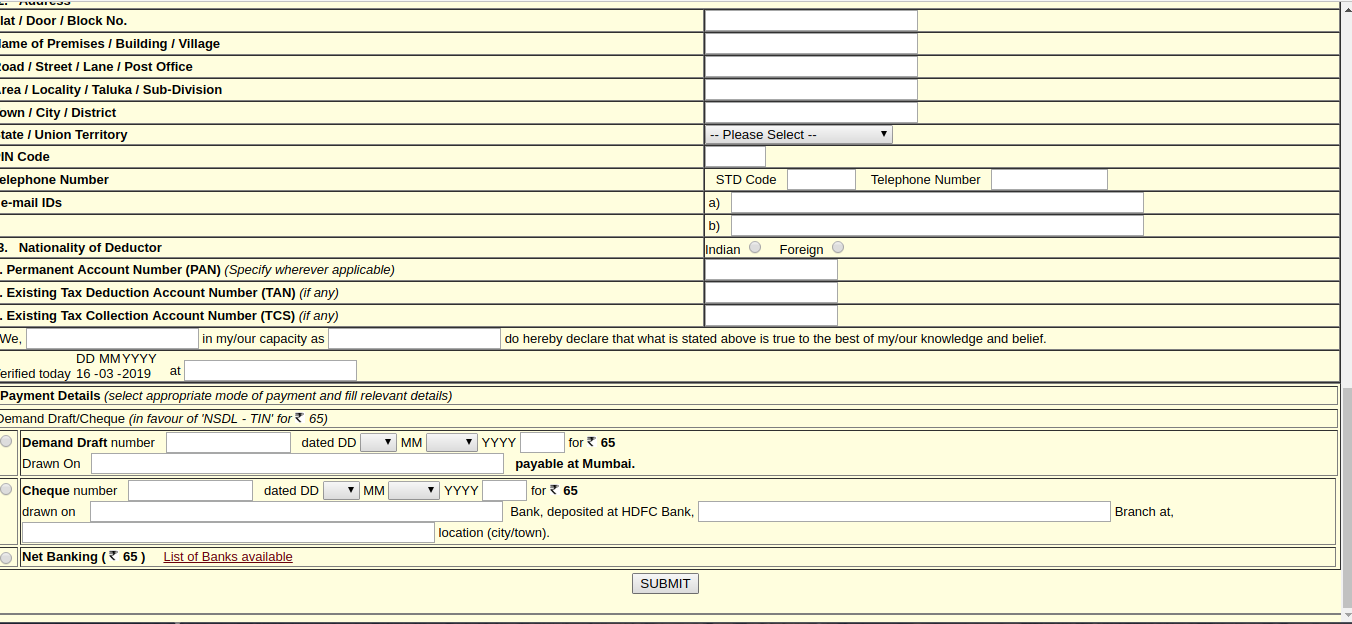

Next, fill in the form and click on ‘Submit’

STEP 8.

As soon as you click on the “Submit button”, an acknowledgment screen will be displayed which contains the following:

- 14-digit acknowledgment number

- Name of the applicant

- Status of the applicant

- Contact details

- Payment details

- Space for signature

STEP 9.

Now, you are required to save the acknowledgment and get a printout of it.

STEP 10.

Now, the printout of the acknowledgment along with other documents is required to be sent to NSDL at –

NSDL e-Governance Infrastructure Limited

5th floor, Mantri Sterling

Plot No.341, Survey No.997/98,

Model Colony

Near Deep Bungalow Chowk

Pune – 411016

How to apply for TAN offline?

Offline TAN application is to be filed in Form 49B in duplicate and submitted to any TIN-FC. You can find the addresses of TIN-FCs at NSDL-TIN website (https://www.tin-nsdl.com). But, in the case of a company, being an applicant you have to fill the Form No. INC-32 (SPICe), if your company is not registered under the Companies Act, 2013 as per the instructions under sub-section (1) of section 7 of the said Act for incorporation of the company.

How can you make payment for TAN allotment?

You have to make the payment of processing fee which is Rs. 55+services tax (as per the applicability). Mode of the payments are given below:

- Demand Draft

- Cheque

- E-payment

- Demand draft/Cheque must be in favor of NSDL-TIN.

- Applicant name and acknowledgment number should be mentioned on the reverse of DD/cheque.

- DD must be payable at Mumbai.

- An applicant who is making payment through cheque shall deposit a local slip. After the successful payment by e-payment mode, an acknowledgment will be displayed. Now, the applicant shall save and print the acknowledgment and send it to NSDL as mentioned in “Submission of a document”

Benefits of TAN Registration

Following are the benefits of TAN registration:

- Deductor can easily receive communication from the Income Tax Department regarding Tax collected at source (TCS) and Tax Deducted at Source (TDS) from the database of updated active TAN details.

- Every deductor will have authenticated login area.

- Deductors will also have below previsions or benefits to download the latest Input file (FVU) for the purpose of preparing correction statement and check the challan status online.

- The deductor can receive a statement showing the status of tax deducted at source (TDS)

- Reconciliation of tax deducted at source (TDS) to TAN holder with regards to Section 200A.

- Deductor can easily upload e-TDS returns online

- That’s it! Registration and verification of TAN are quite simple and easy. You can know your TAN details just by providing a name or TAN number

For more information regarding the TAN registration or PAN Card registration or more, you can visit our website: LegalRaasta. Our experts will take away your tension of a lengthy process. So, here is our contact number 8750008585 and send your query on Email: [email protected]

Related Articles:

Difference between TAN, PAN, DSC and DIN

Income Tax Pan Verification: Eligibility, requirements & Procedure