What is Employment provident fund (EPF) Form 11?

Contents

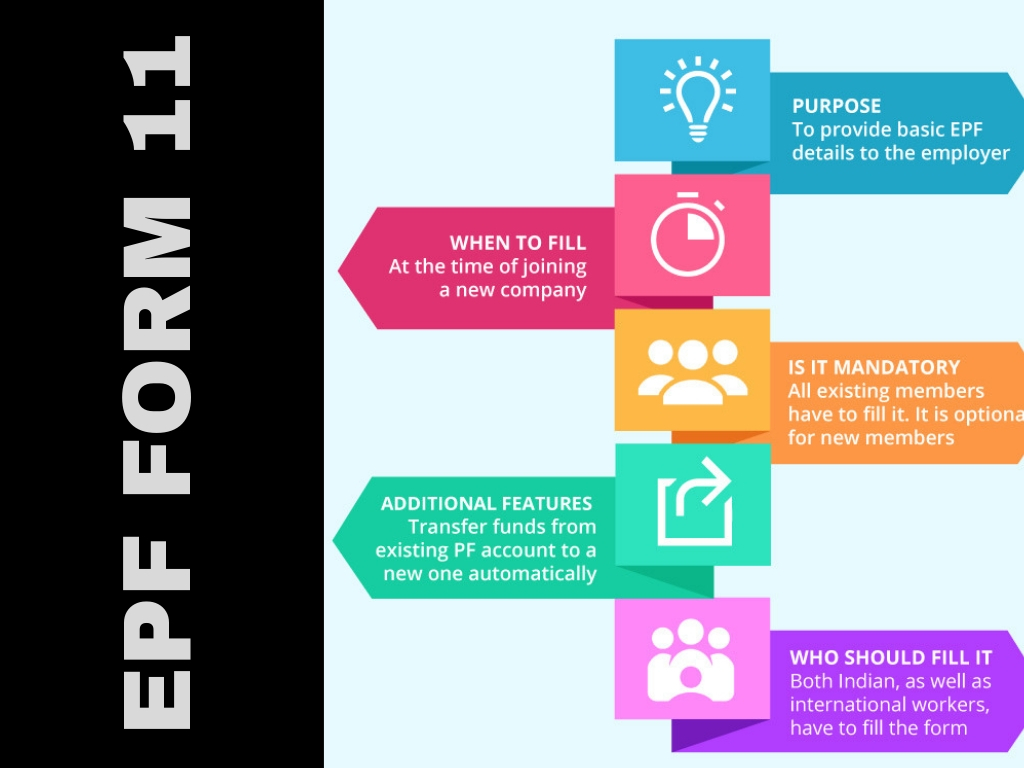

EPF Form 11 is a self-declaration form that requires to be filled by the employee at the time of registering an organization which is included under the Employees Provident Fund scheme as per the EPF Act of1952. All aspects of the employee’s prior EPF account have to be specified in the form and procedure to register for employee provident fund is the foremost activity before applying for form 11.

The form is also utilised to automatically shift the amount from the prior PF account to the fresh EPF account. Earlier, an employee had to fill Form 13 for shifting PF to the fresh EPF account. The automated shift application is entered in this form even after the initiation of revised Form 11,

For EPF registration you can visit the website of LegalRaasta.

Why Form 11 is needed and usage of form 11?

The main purpose of establishing up the Employees Provident Fund was to grow the quality of life of employees and contribute towards them with civil safety and advantages. This form includes essential data concerning an employee. It is compulsory for an employee to mention all the details in it while entering into an organization.

Form 11 is used by the employer is about to create the documents from fresh joining employees. Update and specify it in the UAN portal. Form 11 is submitted for the declaration of an employee for pension schemes and Provident Fund. The employees who are eligible for PF schemes also asked to fill form 11 declaration.

You can download Form 11 form from a governmental official website. Click on the link mentioned below :

https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form11Revised.pdf

How can I obtain Form 11?

The employer is to receive the declaration from fresh joining employees as Form 11 and upload it in the UAN portal.

- For both the pension scheme and provident fund form, 11 is used for the declaration of an employee.

- The Employee who is not eligible for the provident fund is asked to take a form 11 declaration.

The benefit of form 11

Form 11 assists the following benefits:

- If the fresh employee was a member of the EPF scheme before, she/ he will resume receiving advantages of the scheme but under a fresh Member ID.

- If the fresh employee was not a member of EPFO in his earlier employment or was not employed earlier. The salary base in case of employment is more than Rs.15,000 per month in new employment, he/she can adapt not to contribute to EPS or EPF. This kind of employee is called as an “Excluded Employee”.

Members getting Provident fund pension or those who have withdrawn their Provident fund at an initial date are also recognised as excluded employees. - The form can be utilized to automatically shift the provident amount from the earlier account to a fresh one.

- This claim form further facilitates the Provident Fund Department to prepare a complete database which includes significant details of the employees. Moreover, it helps them significantly while investigations, accounts and audits, crosscheck or confirmation of data.

Contents in EPF Form 11 with the format

The ESI registration (Employee State Insurance ) is a compulsory system for the employee’s future benefits.The updated formation of Employee Provident Fund Form 11 needs employees to fill the information as per the form requirements :

- Employee name

- employee date of birth (DOB)

- Father’s name (In case you are married Husbands’ name )

- Marital status

- Gender ( male / female/transgender)

- Email ID

- Mobile number

- Connection of an employee with Employees’ Pension Scheme and Employees’ Provident Fund Scheme (whether he/she was a member of these two schemes)

- Earlier employment details including UAN number and UAN Registration details

- Details of last working day

- scheme certificate number

- Educational credentials

- Details of KYC comprising bank account number, election card, driving licence etc.

- In case employee belongs from abroad country then the passport is a must.

An employer is required to give a document declaring specific facts regarding the data provided by an employee. This document comprises the following aspects.

- Confirmation of KYC credentials

- Universal access number (UAN) of the employee

- Provident fund ID number allotted to the employee

- Date of joining the workplace

Filling EPF Form 11 is a duty and responsibility of the employer. They need to fill the form in respect of those member ids, which have not been given UAN or associated with UAN.In terms of the relationship with the previous employment, UAN and First Time Employment of new members. Also, it manages KYC in terms of the previous relationship. It is the duty of employers to obtain the claim form Form-11 for every new member and state the same for allocation/relation to UAN. The employer must retain the form with him/her and it requires to be completely filled with details and stamped by the employer.

For PF accounts registration, you can call on 8750008585. You can log in to our website LegalRaasta and you will get all detailed information on EPF Registration and EFI Registration. For sending your queries or doubts on provident fund mail us on Email: [email protected].You can download LegalRaasta app for any questions linked with Provident fund registration.

Related Articles

Check the online PF claim status