Introduction

Contents

The Ministry of Finance released a notification on 26th July 2018 which seeks to amend the Integrated Tax(rate) under the Integrated Goods and Services Act, 2017. The notification basically specifies that RCM on services by individual DSAs to banks/NBFCs will be taxed. What this entails is that the services provided by DSAs (Direct Selling Agents) of banks or NBFCs will be charged under RCM (Reverse Charge Mechanism).

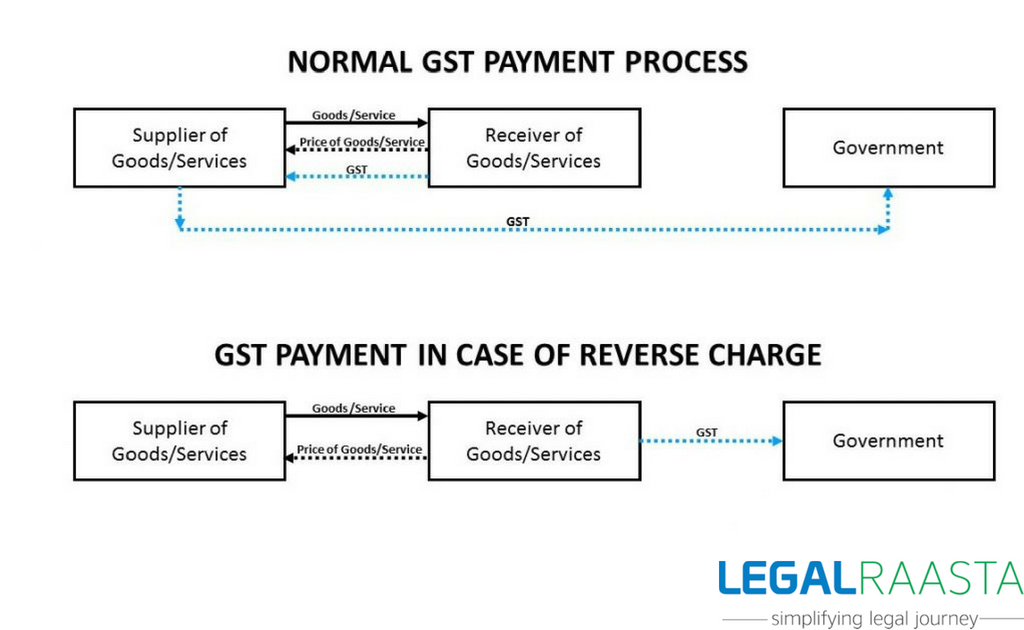

What is the Reverse Charge Mechanism you might ask! Well, it basically means a system where the recipient of goods or services has to pay the tax instead of the supplier. RCM is part of GST rules. Below we give a pictorial representation of the Reverse Charge Mechanism.

Provisions of RCM on services by Individual DSAs

The notification basically adds the following amendments.

- Including DSAs of Banks/NBFCs in the taxable territory under Reverse Charge Mechanism

- Explanation of ‘renting of immovable property’

You can also refer the official notification from the Ministry for your convenience.

Government of India

Ministry of Finance

(Department of Revenue)

New Delhi

Notification No. 16/2018-Integrated Tax (Rate), Dated: 26th July 2018

G.S.R. 684(E).- In exercise of the powers conferred by sub-section (3) of section 5 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), notification No. 10/2017- Integrated Tax (Rate), dated the 28th June 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 685(E), dated the 28th June 2017, namely:-

In the said notification, ‑

(i) in the Table, after serial number 12 and the entries relating thereto, the following serial number and entries shall be inserted, namely: –

| (1) | (2) | (3) | (4) |

| “13 | Services supplied by individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm to the bank or non-banking financial company (NBFCs) |

Individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm. |

A banking company or a non-banking financial company, located in the taxable territory.”; |

(ii) in the Explanation, after clause (f), the following clause shall be inserted, namely: –

`(g) “renting of immovable property” means allowing, permitting or granting access, entry, occupation, use or any such facility, wholly or partly, in an immovable property, with or without the transfer of possession or control of the said immovable property and includes letting, leasing, licensing or other similar arrangements in respect of immovable property.’.

2. This notification shall come into force with effect from 27th of July, 2018.

[F. No. 354/13/2018- TRU]

(Gunjan Kumar Verma)

Under Secretary to the Government of India

Note: -The principal notification No. 10/2017- Integrated Tax (Rate), dated the 28th June 2017 was published in the Gazette of India, Extraordinary, vide number G.S.R. 685 (E), dated the 28th June, 2017 and was last amended by notification No. 3/2018 – Integrated Tax (Rate), dated the 25th January, 2018 vide number G.S.R. 71 (E), dated the 25th January 2018.

It can be challenging to keep up with the latest amendments and changes on GST. Follow our blog to stay up to date with the latest. At LegalRaasta we specialize in a wide range of services including GST registration and ROC Compliances for company registration procedure. Talk to us about your requirements at +91-8750008585 or drop an e-mail at [email protected].