Private Limited Company

Contents

Choosing a company type for your startup can be a challenging task. Your company type defines the direction your startup will take for years to come. With this article, we wish to get you through the procedure to register a private limited company under the laws of the Companies Act, 2013. So before we delve into the process, Let’s get acquainted with the Private Limited Company.

What is a Private Limited Company you may ask? Well, basically, a private limited company is an association of individuals who have registered a company which is held privately for small businesses. Held privately means that the shares of the company are not tradable to the general public. A company can only trade shares if it is a Public Company. See also: Public Company Registration Process.

Characteristics of Private Limited Company

Before you go ahead and register a private limited company, it is good to know what are the characteristics of such a company and how it will shape the future of your startup in the coming years. Here’s a list of the salient features of a Private Limited Company.

- Limited Liability- The personal assets of shareholders/directors face very limited risk in case of heavy losses incurred by the company. The risk to assets is only limited to the value of the shares of individual shareholders.

- Perpetual Succession- In the eyes of the law, Private Limited Companies continue to exist even after the death, bankruptcy or insolvency of any of its members. The life of the company keeps going on.

- Members- A minimum of 2 directors/shareholders are required to start a private Limited company. The maximum number of shareholders is 200. The company can have a maximum of 15 directors at one point in time.

- Exemptions: Private Limited Companies are entitled to many exemptions under the Companies Act. Take A look at Exemptions Private Limited Companies

The Ministry of Corporate Affairs (MCA) looks over the incorporation procedures as well as rules and regulations surrounding corporate companies. The MCA has also taken brilliant measures to ensure faster, smoother processing of company registration with One-Day Company Incorporation.

How to Register a Private Limited Company

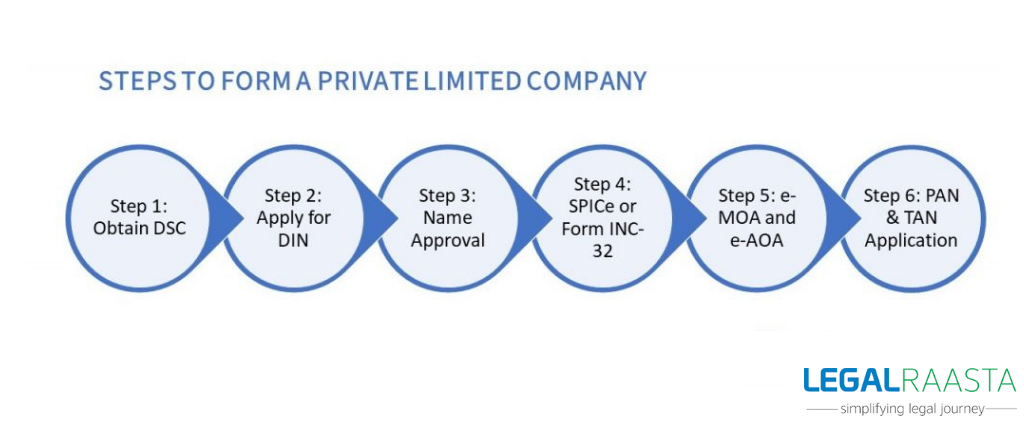

Now getting down to the procedure for registration of Private Limited Company, It is a very simple 6-step procedure. Here’s an illustration to clear it up for you.

Thus at it’s basic, The process to register a private limited company has the following steps

- Obtain DSC(Digital Signature Certificate)

- Apply for DIN(Director Identification Number)

- File for name approval

- Fill and file the SPICe INC-32 e-form

- Submit Constitution of the company i.e. e-MoA(INC-33) and e-AoA(INC-34)

- PAN number and TAN Number Application.

Let’s look at each step in its full detail to cover all aspects of company registration.

- Obtaining DSC

DSC stands for Digital Signature Certificate. It’s a certificate which establishes the authenticity of the Digital Signature. The digital signature is a code to replicate the authority of a hand-written signature. DSC is mandatory for all witnesses and subscribers mentioned in the Memorandum of Association and Articles of Association. DSC can be obtained from government certifying agencies. The cost of getting the DSC depends on the certifying agency - Apply for DIN

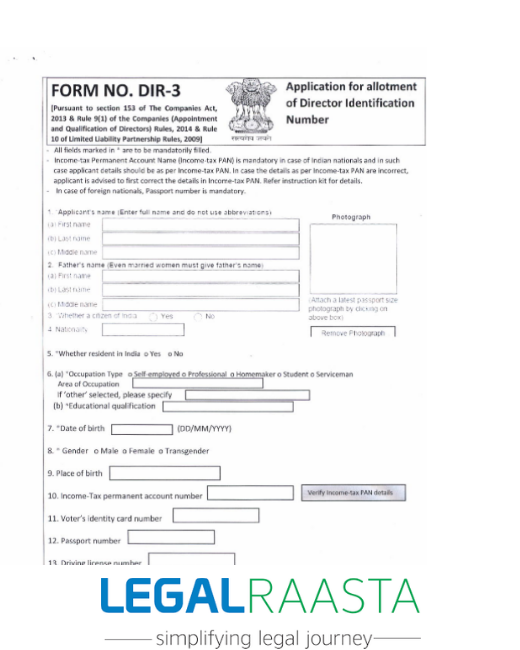

DIN stands for Director Identification Number. As the name suggests, DIN is used to uniquely identify each director uniquely. The Process for acquiring the DIN is now incorporated within with SPICe e-form (INC-32) for a maximum of 3 directors. For existing companies, Directors can apply for DIN by filling DIR-3 form. - Name Approval

Filing for name approval can be tricky because getting name approval is a tedious process. Even though the procedure for name incorporation now comes within the INC-32 e-form (SPICe), you can still utilize the RUN (Reserve Unique Name) service to apply for the name of the company. Both provisions have the option of filing for one unique name otherwise, you will have to redo the documentation in case the name gets rejected. So, choose the name wisely! - Filing e-Form INC-32(SPICe)

The SPICe forms are basically a simplified performa for smoothening the process of incorporation of a company. The new e-form has provisions for the following- Obtaining DIN

- Filing for name approval

- Incorporation Certificate

- PAN and TAN number application

- Filing the Constitution of the Company

The constitution of the company basically means Articles of Association (AoA) and Memorandum of Articles(MoA). The MoA and AoA of a company can be filed online via e-form MoA(INC-33) and AoA(INC-34). These forms need to be digitally by the subscribers. - PAN and TAN Application

PAN and TAN application are now incorporated in the new SPICe forms however, you can also apply for PAN and TAN number through form 49A and 49B respectively.

Document Checklist to register a private limited company

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Declaration and Affidavit by directors and first subscribers

- Proof of Office Address

- Utilities Bills’ Copy not more than 2 months old (Electricity, Gas, Water Bills etc.)

- Copy of approval if the proposed name is containing words/expressions which need authorization by the Central government

- In case of proposed name based upon a registered trademark then it is mandatory to attach trademark registration certificate or trademark application copy

- NOC from sole proprietors partners /associates/ existing company

- Proof of identity and residential address of subscribers.

- Proof of identity and residential address of directors.

If the Directors are foreign nationals, A copy of Passport, as well as Residential Address Proof, is required in addition to above-mentioned documents.

The cost to register a Private Limited Company(Government Cost)

The following is the government fees required for registration:

| Process | Fees |

|---|---|

| Plan Amount | ₹ 10999 |

| DSC | ₹ 2000 |

| DIN | ₹ 1000 |

| Professional Fees | ₹ 3799 |

| Stamp Duty(approx) | ₹ 2500 |

| Notary Fees | ₹ 500 |

| Govt Fees(RUN, PAN, TAN) | ₹ 1200 |

| Goods and Services Tax @ 18% | ₹ 684 |

| Total | ₹ 22682 |

Thus, it is a comprehensive and very intensive work to register a private limited company. It can be a daunting task to stay up to date with all the procedures and forms changes. You can follow our blog to stay up to date with the latest in Private Limited Company registration. At LegalRaasta, we can understand that it is a hassle to get the legal formalities done. Therefore, we offer a wide range of services including Private Limited Company Registration, GST registration as well as Income-Tax Return filing. Talk to us about your needs at +91-8750008585 or drop us an e-mail at [email protected].