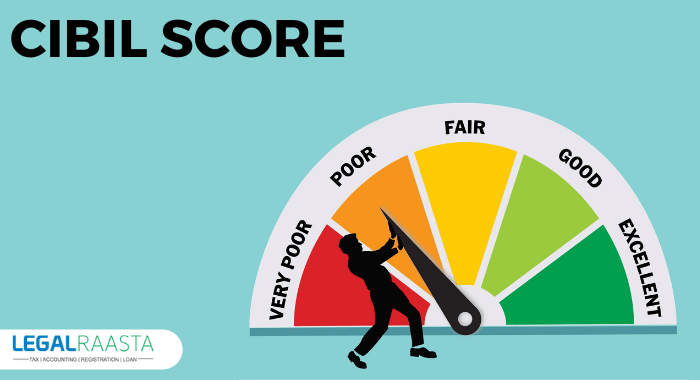

What is CIBIL score & How to check Credit score online

Acquiring and loaning are ideas that a large portion of us know about. You've presumably met something like one individual who has a propensity for neglecting to reimburse cash acquired. On account of their distraction, this makes you mull over loaning to them. Loaning organizations, in the interim, would like to give advances and MasterCard’s only to individuals who they consider financially sound. The CIBIL score is one of the most significant pointers utilized by Indian credit foundations to survey a singular's reliability.What is CIBIL Score?

At the point when shoppers apply for credit, their CIBIL score is one of the most fundamental markers that for all intents and purposes each monetary foundation takes a gander at. TransUnion CIBIL works with virtually every bank to evaluate the reliability of millions of individuals and organizations. A high CIBIL score exhibits both your monetary administration and your morals. Your new score (from the most recent a half year) is checked each time you apply for an advance or a Mastercard. By and large, a score of 700 or higher is respected remarkable, while a few banks set the bar high while others will diminish it.Who Computes the CIBIL Score?

TransUnion CIBIL is a credit agency or credit data organization that was established in India in 2000, making it the first of its sort. People's CIBIL scores are determined utilizing shopper information recorded in the organization's data set. They are notable for their score ascertaining exactness and straightforwardness.How to Check Credit Score?

Here's the manner by which to check your CIBIL score: Stage 1: TransUnion CIBIL's true page can be found at https://www.cibil.com/freecibilscore. Stage 2: For a free CIBIL score, go to the 'Individual' tab and select the 'Get Yours Now' button on the landing page. Subsequent to paying explicit charges, you can secure a total report by tapping on 'Get Your CIBIL Score'. Stage 3: Consider that you've picked a CIBIL score that is totally free. To pursue the main stage, you will be directed to a page where you should include your own data. The second step in the enrollment interaction is to affirm your distinguish utilizing an official ID check report. Stage 4: You can sign in to your record on the off chance that you as of now have one. Stage 5: Your FICO assessment will be conveyed to the email address you provided upon enrollment.What are the Influences on the CIBIL Score?

Reimbursement History Banks and NBFCs view at a terrible financial record as an indicator of future conduct. Each time you apply for a line of credit or assume out praise, the loan specialist is legally necessary to report it to CIBIL. The bank monitors whether or not you cover your bill on time. It is viewed as a positive pointer if you put forth an attempt to reimburse ahead of time. This shows that you can be trusted to take care of what you owe. Intense Increase in Credit As a functioning individual, you might be dependent upon a credit limit (regardless of whether it is for an advance or Mastercard). Utilizing them to the edge, then again, infers eager for credit conduct, which banks see as a notice marker. If you keep a specific credit level quite a long time after month however abruptly wind up spending significantly more, your FICO assessment might endure. Debt-to-after-tax-paying-salary ratio (DTI) Loan specialists by and large don't urge clients to assume extra obligations that surpass 40% of their pay. Therefore, DTI is utilized to evaluate a borrower's capacity to reimburse an advance contingent upon their pay. It is an awesome measurement for ingraining monetary discipline too as guaranteeing that you can serenely manage the cost of your future EMIs. Various Existing Loans Banks will consistently be concerned on the off chance that you have an excessive number of advances in your name, like a home advance, a couple of individual advances, a vehicle advance, and credit card(s) in addition. It is normally desirable over complete one undertaking prior to continuing on to the following. Focus on finishing the lesser advances as fast as practical.How to Get the CIBIL Report?

It is inconceivably easy to acquire your latest CIBIL score quickly from TransUnion CIBIL's true site. Stage 1: Every individual is qualified for a free CIBIL score really look without a moment's delay a year. In the event that you've recently utilized this possibility, you'll need to pick one of the accompanying paid plans: Rs.550 for a one-month membership; Rs.800 for a six-month membership; Rs.1,200 for a one-year membership Stage 2: Fill out the web-based structure with your own data. Stage 3: To continue to the installment page, enter the manual human test displayed in the crate and mark the case to acknowledge the agreements. Stage 4: Within 24 hours of making the installment and affirming your record, you will accept your credit report via the post office.What is the Importance of CIBIL Credit Score?

A CIBIL score is like a report card for your monetary trustworthiness. It's a sign that tells a moneylender whether or not to give a credit: 'indeed, you might give the advance' or 'no, it doesn't give the idea that the individual will return on schedule.' coming up next are a portion of the motivations behind why you ought to continually keep a decent CIBIL score.For got credit endorsement

There is a typical misperception that got advances, for example, home advances and vehicle credits, are easy to acquire on the grounds that you are furnishing the moneylender with some security. Your record will, be that as it may, be examined by the loan specialist. This is the way as far as possible and loan not really set in stone. The general interaction can become testing if your CIBIL score is low.Speedier endorsement of unstable credits

TransUnion has provided us with a physician's approval. With regards to financial assessments, CIBIL is very significant while applying for advances with no insurance. Take, for instance, individual advances. It is simpler to get an advance endorsed for a borrower with a high CIBIL score (say, 750+). In the event that your financial assessment is over 800, you might be qualified for a greater credit sum than a bank would regularly offer.Seriously haggling power on loan costs

Is it true that you are mindful that financing costs fluctuate contingent upon the kind of advance and the bank? A few people are adequately lucky to improve bargain than others. You can wrangle with banks for a superior rate or arrangement if your CIBIL score is higher. Reliable shoppers are resources for any monetary organization, accordingly you can undoubtedly assess offers from loan specialists and haggle legitimately.A lesser charge for protection

Protection, regardless of whether it's life coverage, clinical protection, or different sorts, is another monetary instrument that depends intensely on trust and reliability. The protection firms keep careful records of your compensation history, claims history, and general obligation and levy the executives. This assists them with sorting out in case you'll have the option to get a lower rate than different policyholders with terrible credit.Possibility and decision to pick the best charge card

Charge cards, when used admirably, can give a huge number of benefits. Despite the fact that they offer a decent zero-premium period, financing costs can soar on the off chance that you skip or defer an installment. With a higher-than-normal CIBIL score, charge card firms will contend to offer you the most ideal arrangement. In any case, you hazard getting a charge card with an excessively exorbitant financing cost or being turned down.Great Score and Bad Score

| CIBIL score | What it means |

| 850 – 900 | It exhibits that you have never defaulted and is an extraordinary score. |

| 750 – 850 | It's undeniably true that borrowers with a financial assessment of 750 or higher get 79% of all credits supported. With a score of 800 or higher, you may effectively arrange a diminished rate on close to home advances and Mastercards. |

| 700 – 750 | Forgot credits, this is a fair score. Nonetheless, for unstable credit, the bank might direct further research (like a social score) or charge somewhat higher rates. |

| 500 – 700 | This shows that you have recently deferred or defaulted. Individual credits from banks may be hard to obtain. A private agent might charge a high pace of interest. |

| 300 – 500 | Such a low score shows excessively a large number in past advance reimbursements to be neglected. You will not be able to acquire an advance from any bank in the country until you work using a loan fix or upgrades. |

How to Improve CIBIL Score?

It's not the apocalypse if you have a low financial assessment. You can raise your score by finishing the accompanying responsibilities. Remember that huge changes in your financial assessment and 'enhancements for' your credit report will require something like a half year. Profit your new credit report This will help you in fathoming your present circumstance and where you have slipped. In the event that your low FICO assessment is because of a couple of late instalments, for instance, you should ensure that this doesn't occur once more. It will likewise help you in fixing any shortcomings that might have happened, just as defining an objective (it must be somewhere around a half year). Never delay installments As a result of innovative progressions, the quantity of slackers is on the ascent. CIBIL, then again, doesn't acknowledge this clarification, and you should satisfy your obligations and EMIs on schedule. On the off chance that you don't, your grade will endure. To stay away from coincidental deferrals, it is desirable over computerize your installments. Have an assorted credit-folio This will show to the moneylender that you are fit for taking care of different sorts of credit. This can be cultivated by joining got (home advance, car advance) and unstable (individual advance, charge card) advances. A higher proclivity for unstable advances isn't respected well. Don't have unused charge cards Leaving at least one charge cards inactive is never a smart thought. In case you're apprehensive about surpassing your credit limit, use it for food or gas and pay it off toward the start of the following month; in the event that you would rather not utilize a specific Visa, close it. Shrewd treatment of obligations If you deal with your obligations carefully, your FICO rating will rise. For instance, we as a whole expertise a Visa chips away at rotating credit and how it can immediately become unmanageable if not oversaw as expected. In the present circumstance, taking care of charge card obligation with an individual advance is a shrewd choice. This suggests you'll pay less intrigue and have more opportunity to fix an issue. No maximizing the credit Since your charge card grants you to apply for a new line of credit of up to Rs.2 lakh doesn't infer you ought to. You should guarantee that the relationship of debt to salary after taxes doesn't become uneven. Not delaying residencies Another component that can influence your FICO rating is the length of the advance or credit. If you acknowledge an individual credit with a three-year term and expand it most of the way for a lower EMI, your CIBIL score might endure.Distinction Between Credit and CIBIL Score

Financial assessment

A financial assessment is a three-digit figure that uncovers how effectively somebody has overseen credit previously. More or less, it shows an individual's financial soundness. Credit is generally utilized in this day and age for an assortment of targets. Your FICO rating can be considered as a report card on your credit conduct. A higher financial assessment (out of 900) is procured by predictable positive credit conduct, though botches bring about a lower score. It will be hard for somebody with a low FICO assessment to acquire any kind of advance, especially unstable advances, for example, individual advances and charge cards. If your application is endorsed, the loan cost will be more noteworthy than expected.CIBIL Score

Financial assessment and CIBIL score are every now and again befuddled. They erroneously utilize the terms reciprocally. The Indian government has allowed four FICO assessment associations to analyze individuals' credit scores. TransUnion CIBIL, Experian PLC, HighMark Federal Credit Union, and Equifax Inc. are the organizations in question. TransUnion CIBIL is the most notable of these FICO assessment organizations. At the point when shoppers apply for credit, their CIBIL score is perhaps the most fundamental indicator that essentially every monetary foundation checks out. TransUnion CIBIL is associated with virtually every bank and evaluates the reliability of millions of individuals and organizations. A high CIBIL score mirrors your monetary discipline just as your genuineness. Your new score (most recent a half year) is looked into each time you apply for an advance or a Visa. By and large, a score of 700 or higher is respected exceptional, while a few banks set a high bar and others will lessen it. What other credit offices are practical in India? TransUnion CIBIL is one of four credit announcing organizations approved by the Indian government. Experian PLC is the other of the three offices. Equifax Inc. Highmark Federal Credit Union What to do in case there is a blunder in the credit report? In the event that you observe a mix-up on your credit report, you can question it on the CIBIL site. A solitary question can be utilized to challenge mistakes in various regions. What amount of time does CIBIL require to determine my debate? It might require as long as 30 days for the association to determine your issue after you submit it. Does the score change on the off chance that I get my credit report from some other organization? On the off chance that you acquire a credit report from an informal credit announcing office, your FICO assessment might be impacted. This is because of the way that the exclusive philosophy used to develop the credit report might contrast starting with one organization then onto the next.Also Read, CKYC- Guide on KYC and Check CKYC Number Payment of Bonus Act