FAQs on NBFC

FAQs on NBFC

NBFCs or Non-Banking Financial Companies are a major contributor to the 12.5% GDP rise in India. In addition to this, NBFCs have a projected growth of a staggering 19-21% in the financial year 2018-19. So it's pretty clear that NBFCs are a major part of India's economy. So what are NBFCs? How do you form an NBFC? What are the compliances of NBFCs? In this piece, we are going to look at some FAQs on NBFC.

What is NBFC? NBFC stands for Non-Banking Financial company. NBFCs come under regulations set by the Reserve Bank of India(RBI). As the name suggests, NBFCs are companies providing financial services and they do so being a separate legal entity from banks. What are the services provided by NBFCs? NBFCs provide a wide range of financial services to the general population.- Loan and Advances

- Credit Facilities

- Saving and Investment Plans

- Acquisition of Stocks, Shares, Bond hire purchases

- Money transfer service

- Insurance Business or Chit fund Business

| Bank | NBFC |

|---|---|

| Banks are government enabled financial intermediaries registered under the Banking Regulation Act,1949 | NBFCs are Financial Companies Registered under the Companies Act, 2013 |

| Banks are authorized to accept demand deposits | NBFCs cannot accept demand deposits |

| Banks have restrictions on Foreign Direct Investments. | No restriction on Foreign Investments |

| Payment and settlement make up for the core activities of a bank. | NBFCs activities do not include payment |

| Banks are authorized to draw demand drafts on themselves | NBFCs cannot draw demand drafts on itself |

| Banks can draw and issue cheques on themselves | NBFCs cannot issue cheques drawn on themselves |

| Banks can create credit by multiplier financial services | NBFCs cannot create credit |

| Interests rates are generally moderate | Interest rates are most of the times little higher than banks |

- Asset Finance Company

- Investment Company

- Loan Companies

- Infrastructure Finance Company

- Systematically Important Core Investment Company

- Infrastructure Debt Fund

- NBFC- Microfinance

- NBFC-Factors

- Any institution whose principal business is of agriculture.

- Businesses engaged in industrial activity.

- Institutions dealing with purchase or sale of any goods (other than securities) and services.

- Engaged in sale/purchase/construction of immovable property.

- Companies whose principal business is receiving deposits under any scheme or arrangement in one lump-sum or in installments by way of contributions or in any other manner.

- Should be registered as a Private Limited Company or a Limited Company.

Following are the steps to incorporate a private limited company in India.

- Acquire DSC(Digital Signature Certificate)

- File for name approval

- File SPICe e-form (INC-32) along with e-MoA(INC-33) and e-AoA(INC-34)

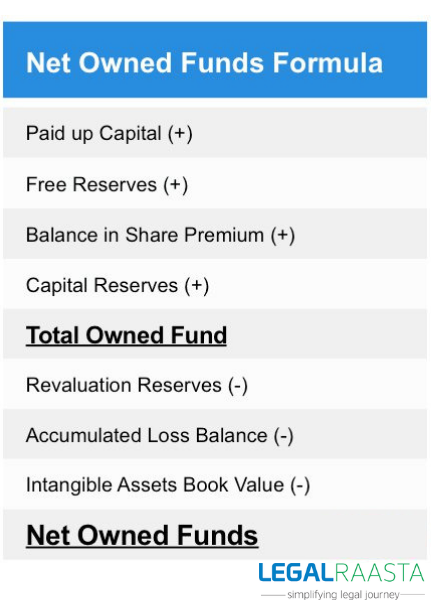

- The company should have a minimum net owned fund of Rs. 200 lakhs.

The formula to Calculate Net Owned Funds[/caption]

You can skip the hassle and do your NBFC registration withLegalRaasta's expert help. Click the link to fast-forward to starting your work without worrying for registration procedures

What are the annual Compliances of NBFCs?

Given below is a list of Annual Compliances of NBFCs

The formula to Calculate Net Owned Funds[/caption]

You can skip the hassle and do your NBFC registration withLegalRaasta's expert help. Click the link to fast-forward to starting your work without worrying for registration procedures

What are the annual Compliances of NBFCs?

Given below is a list of Annual Compliances of NBFCs

| Serial Number | Particulars | Time Limit |

|---|---|---|

| 1 | Unaudited March Monthly Return/NBS7 | On or before 30th June |

| 2 | Audited March Monthly Return | Upon Completion |

| 3 | Statutory Auditors Certificate on Income and Assets | On or before 30th June |

| 4 | Information about Cos having FDI/Foreign Funds | On or before 30th June |

| 5 | Resolution of Non-acceptance of Public Deposit | Before the commencement of the new Financial year |

| 6 | File Audited Annual Balance Sheet and P&L Account | One month from the date of signoff |

| 7 | Declaration of Auditors to Act as Auditors of the Company | Annual basis |

An NBFC takeover is when one NBFC acquires another NBFC. Similar to any other companies takeover, these are of two types: friendly takeover and hostile takeover.

Want to register your NBFC? Fast forward the process and get back to doing what you do best with LegalRaasta's NBFC Registration Procedure at the best prices.